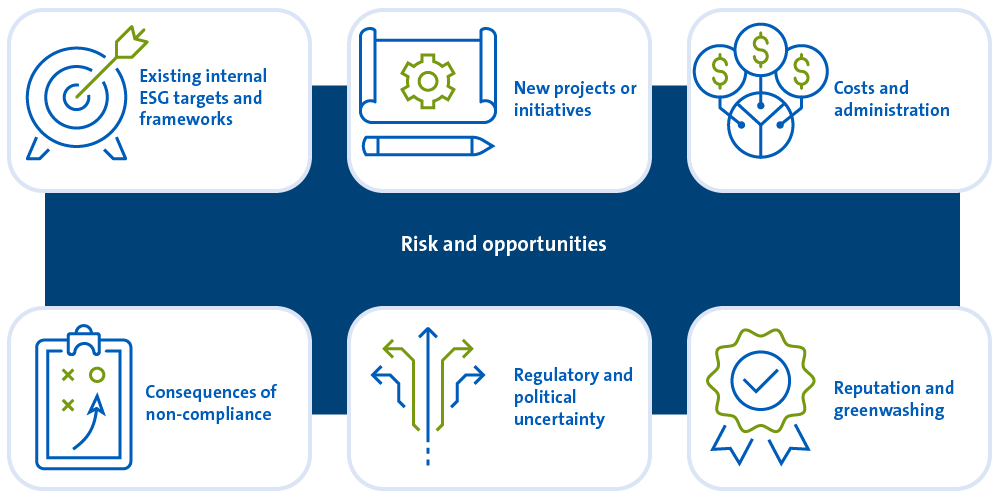

Risks and opportunities

Borrowers and lenders looking to implement green and sustainable finance should give close attention to the following considerations:

Existing internal ESG targets and frameworks

Does your organisation already have a robust ESG mandate that can be supported by green finance? Has your organisation developed a sustainable finance framework that sets out how debt or bond issuance would comply with the industry standard, such as the APLMA / LMA / LSTA principles? Borrowers should review their CSR reports for existing ESG reporting, metrics and goals within the company and consider whether any existing internal ESG targets or sustainable frameworks may be used for KPIs or certification purposes of the green financing.

New projects or initiatives

Is there potential for new projects that can be financed by green or social loans or are there new initiatives that can be implemented by the company that could satisfy the requirements of green finance? Borrowers could consider any ESG projects and capex already contemplated by the business, and how these fit in with the business' strategy.

Costs and administration

There may be additional upfront and ongoing costs and administration in putting together green financing. These costs are diminishing as more market precedents are established, but may include the initial verification or assurance of the sustainability of the loan by an external adviser, which can also take time (for example, it may add a month or so to a refinancing timetable). There are also ongoing compliance and reporting obligations on the company.

Consequences of non-compliance

Borrowers should consider the impacts of non-compliance set out in the agreement. Even if there is no event of default consequence for failure to comply with sustainability obligations, borrowers should be mindful where terms of the green financing require public disclosures in addition to reporting to lenders regarding sustainability performance. In part this can be mitigated by selection of SPTs that, while ambitious, are achievable over the tenor of the loan.

Regulatory and political uncertainty

Conflicting political discourse around climate change and renewable energy in Australia hampers our attractiveness as a destination for foreign green investment, which may include green finance. However, as discussed above, there has been a significant increase in green investment in Australia across a number of sectors and given the way the products are currently structured, there appears to be limited downside from a regulatory perspective in using green finance.

Reputation, greenwashing, and breach of law

Reputational impacts should be considered given SLLs, green loans and social loans are often subject to public commentary. In particular, a growing concern is 'greenwashing' which, in this context, refers to use of green finance to exaggerate a borrower's green credentials. In its extreme, greenwashing could be considered a form of misleading and deceptive conduct with legal consequences (e.g. class actions or attention from regulators such as ACCC, ASIC or APRA for breaches under the Australian Consumer Law or the ASIC Act). The risk of scrutiny for greenwashing is more acute in challenging sectors (such as the fossil fuel sector and related infrastructure), where there has been negative media commentary in respect of the adequacy of sustainability targets set in SLLs by such companies and accusations that the promotion of the use of green finance products is misrepresenting the overall environmental impact of the operations. The counter argument is that SLLs are still incentivising such companies to improve their ESG outcomes and therefore are still a step in the right direction.

Observations and recent experience

Allens is at the forefront of green and sustainable financing, recently working with clients to complete several transactions involving green and social loans and SLLs.

We have observed a significant uptick in demand for green and social financial products and an evolution in the Australian financing market to meet that demand, from more diverse and nuanced products (eg ESG derivatives, sustainability linked bonds and even talk of new products such as 'blue bonds') to financial institutions establishing dedicated green and social financing teams.

Much of that momentum has been driven by growing expectations for corporates and financiers to be active participants in Australia's transition to a sustainable and socially responsible economy. To help meet those expectations, borrowers should understand what green and sustainable financing is and how it can play a part in their broader ESG strategy.

If you are interested in understanding more about green and sustainable financing, please contact the Allens team. We would be delighted to share our experience and discuss what it could mean for you.

Light Rail Green Loans

Allens recently advised lenders on the A$700m green loan refinancing of the operational Sydney Light Rail PPP.

Loan certified under Climate Bonds Initiative standards and confirmed by external reviews as consistent with APLMA/LMA/LSTA Green Loan Principles.

Follows Allens advising on the A$280m green loan refinancing of Canberra Light Rail PPP in December 2020 and the A$630m green loan for Qld New Generation Rollingstock raised in May 2021.

Royal Adelaide Hospital PPP

Allens recently advised lenders on the A$2.2bn project refinancing.

First hybrid green loan and social loan, largest green loan for a PPP in Australia to-date and first healthcare 'sustainability loan’.

Hospital's critical social function of providing access to essential healthcare and education services as the state's largest accredited teaching hospital enabled the project to meet the APLMA's Social Loan Principles. Achieved 4 Star Green Star – Healthcare 'As Built' rating from the Green Building Council of Australia.

Reporting on KPIs for life of project.

NSW Land Registry Services

Allens recently advised NSW LRS on the A$1.93 bn refinancing involving an A$300m sustainability linked facility.

First SLL in Australia to include Indigenous reconciliation goals.

Included pricing adjustments for:

- greenhouse gas emission reduction;

- Reconciliation Action Plan implementation;

- gender diversity in senior management; and

- leadership in GRESB Infrastructure Asset Assessment.

Coles SLL Refinancing

Allens recently advised Coles on the $1.3bn refinancing involving 4 year SLL facilities with its existing bilateral lenders.

Incentivises Coles to accelerate its sustainability goals through pricing adjustments linked to the following targets:

- reduction of Scope 1 and Scope 2 CO2 equivalent emissions;

- increase of total waste diverted from landfill; and

- percentage increase of women in leadership roles.