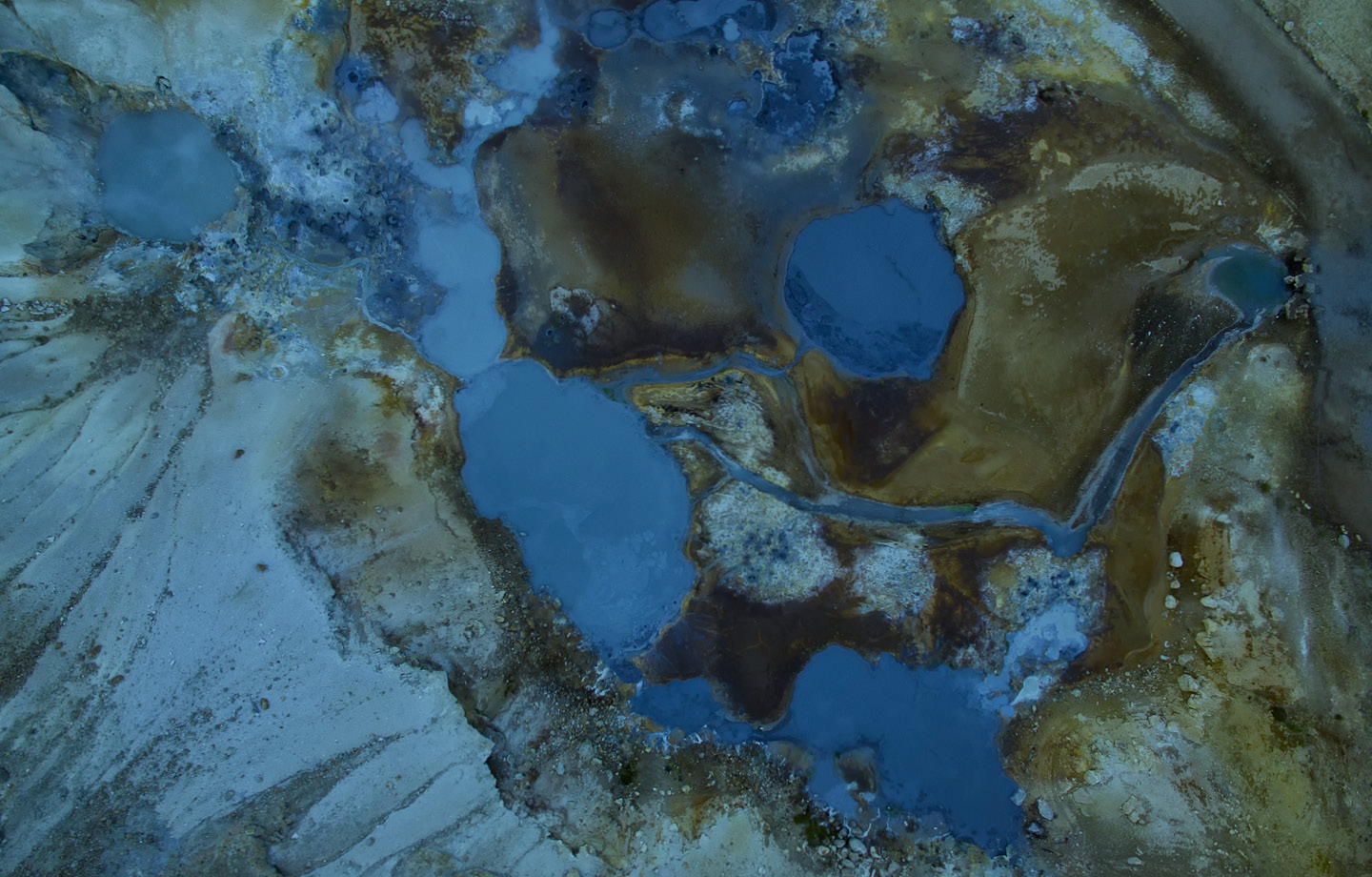

Overview

There is a growing appetite for litigation and regulatory enforcement in the insurance industry. In the wake of the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (the Financial Services Royal Commission), regulators have been given enhanced tools and a greater mandate to litigate, while aggrieved policyholders may feel emboldened to pursue individual claims. 2021 has also seen ongoing legislative reform in this area.

In this landscape, companies selling insurance products need to be more cognisant than ever of the scope of their obligations and what precautions they can take to protect themselves against litigation and regulatory risk.

Our report addresses a number of recent reforms and key risks faced by insurers — including the introduction of civil penalties for the duty of utmost good faith under the Insurance Contracts Act 1974 (Cth); claims handling activities being regulated as a financial service; the unfair contract terms regime, which now applies to contracts of insurance; and recent trends in regulatory behaviour — to give practical guidance to insurance providers in managing their exposure.

Key themes

Spotlight on insurance

The Financial Services Royal Commission exposed important failures within the insurance industry which, in turn, have resulted in increased regulatory and consumer scrutiny on the sector. That trend has been compounded by subsequent events, from Australia's catastrophic bushfires to the ensuing COVID-19 pandemic. Australian residents and business owners are making insurance claims in significant numbers and, in an already 'hard' market for important insurance lines, there has been an increased focus on insurers' claims handling practices.

Active enforcement agenda

We expect to see increased regulatory activity in the insurance sector for the foreseeable future. Notwithstanding the demise of ASIC's controversial 'why not litigate?' stance, incoming Chair Joseph Longo has made clear that ASIC will not be retreating from an active enforcement agenda (although it may look somewhat different to before, with a revitalised role for enforceable undertakings in conjunction with formal proceedings). In its recent 2021 Annual Report, ASIC has continued to identify insurance-related misconduct as an ongoing 'enforcement priority'. ASIC has singled-out insurance-related enforcement matters since December 2020 by tracking them in its regular Enforcement Updates. As at 1 July 2021, ASIC reported six insurance-related enforcement matters before the courts, down from nine on 1 January 2021, but still a steep increase on previous years.

Duty of utmost good faith 'given teeth'

Following a recommendation of the ASIC Enforcement Review Taskforce, the duty of utmost good faith is now a civil penalty provision. Civil penalties of up to $11.1 million per contravention (or 10% of annual turnover) may apply to conduct occurring on or after 30 March 2019. Recent decisions of the Federal Court in ASIC v Youi and ASIC v TAL have highlighted the breadth of this obligation and the importance of transparency and reasonableness in how insurers engage with policyholders. As greater certainty emerges around the scope of the duty, we expect to see policyholders relying on it more frequently when pursuing individual claims, as well as growing use of the provision in regulatory enforcement activity.

Claims handling services to be provided 'efficiently, honestly and fairly'

From the start of next year, the requirement to hold an AFSL (or to be authorised by an AFSL holder) will apply to a range of claims handling and settling services. This means that entities providing those services will be subject to the general obligations of AFS licensees, including the overarching duty to act 'efficiently, honestly and fairly' under s912A(1)(a) of the Corporations Act 2001 (Cth).

Claims handling is often a contentious process, with insurers needing to confirm policy responsiveness and ensure that losses have been properly incurred, before making indemnity decisions. However, inappropriate management of this process may now result in significant penalties of up to $11.1 million per contravention or 10% of an insurer's annual turnover. We see this duty creating 'pressure points' for insurers focused on resolving claims in a timely manner, carrying out investigations transparently and with procedural fairness, and in ensuring that information requests are appropriately targeted to the key issues in dispute.

Unfair insurance contracts

As ASIC continues to test out its new powers to address unfair contract terms, we expect to see a particular focus on insurance policies.

Following legislative reforms in early 2020, the unfair contract terms regime now applies to many standard form insurance contracts that were entered into or renewed from 5 April 2021. In the lead up to this change, ASIC undertook a targeted review of various insurance arrangements and identified a number of terms it considered to be 'unfair'. Further changes are also in the pipeline with the Federal Treasury's recent release of exposure draft legislation. In this context, insurers should be wary of one-sided provisions that create unnecessary barriers to an insured lodging a legitimate claim, or that significantly reduce the cover offered where compliance is unfeasible in the circumstances.

Future outlook

Further regulatory burdens are on the horizon, with changes to anti-hawking laws, deferred sales requirements for add-on insurance, the new Design and Distribution Obligations regime and a revised General Insurance Industry Code of Practice, just to name a few. A lot of work lies ahead for insurers, both in adjusting their existing sales models and processes, and managing growing litigation and regulatory risk into the future.