In PE Horizons 2021, we predicted the year could be one of, if not the, busiest years ever for dealmakers in Australia. Although our prediction proved to be correct, to the surprise of many, traditional PE investors had a relatively mixed year. While many of the axioms that have characterised PE investing in Australia over the last five years remained in place (ie strong fundraising conditions, readily available debt finance and a favourable environment for M&A), suggesting that dealmaking would be elevated, there can be little doubt that PE investors did not keep pace with the broader equity market and other investors with access to cheaper pools of capital. With listed company valuations soaring to new heights, most PE investors looking at ASX-listed companies were either rejected early by target boards, or unable to justify their initial valuation and therefore walking away from the opportunity. As a result, long term infrastructure investors and cashed-up strategic buyers accounted for almost all significant public M&A activity in 2021. A similar story unfolded in the private M&A space, where most of the big-ticket M&A involved acquisitions by acquisitive long term investors and cashed-up strategic acquirers.

Only a few months ago, these conditions looked almost certain to continue in 2022. However, only a few months can feel like a lifetime in M&A. The corporate optimism and dealmaking bullishness that characterised the past year has been replaced with a distinct sense of caution. The war in Ukraine and consequent dislocation in global energy markets has led to the spectre of rising inflation, increased interest rates and significant market volatility.

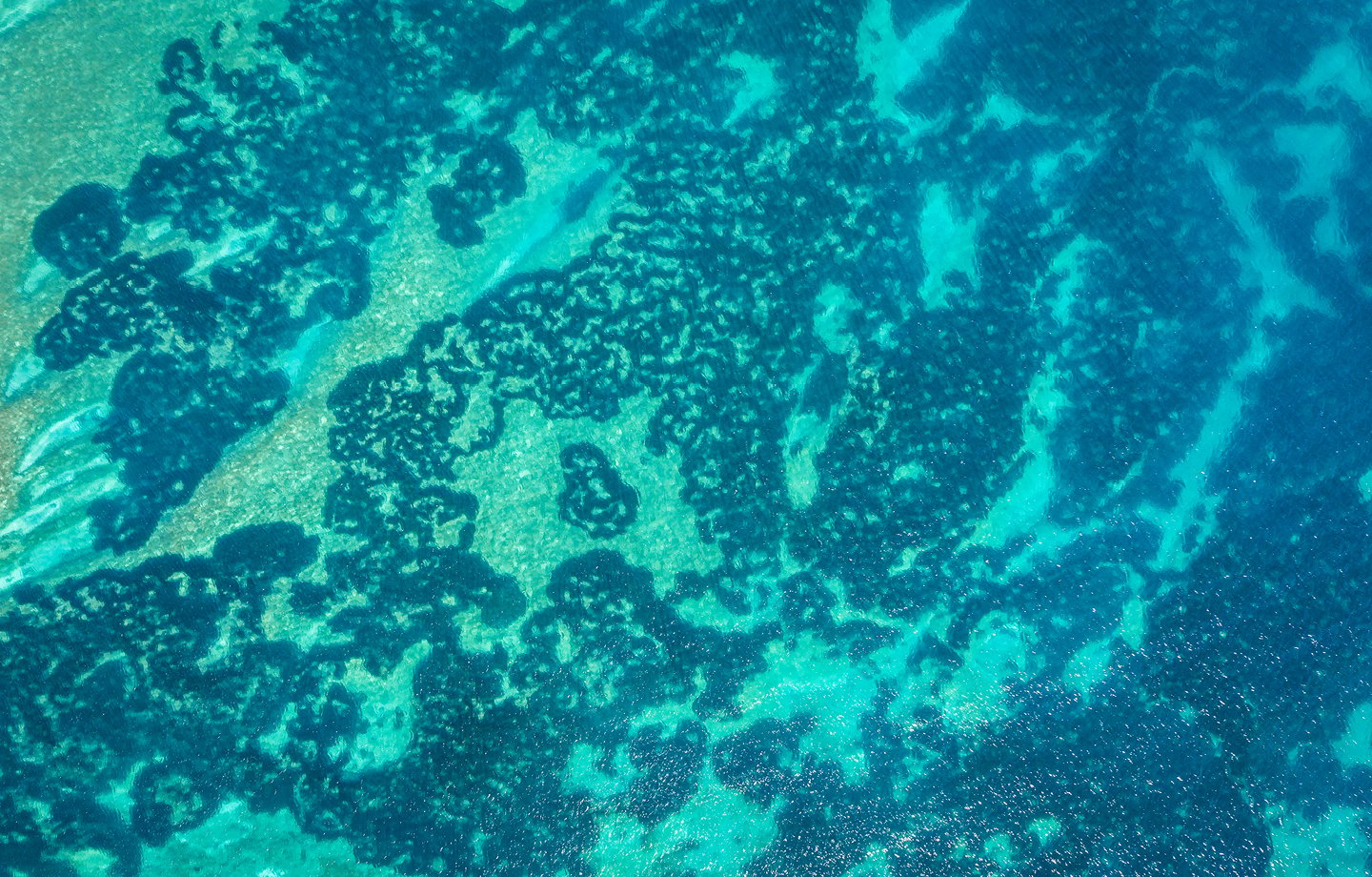

As blue skies have been replaced with dark clouds, it's an opportune time to ask: what does this mean for PE activity in 2022? Our response is a simple one – volatility means opportunity.