Restructuring and insolvency: key takeaways

As the expiration dates for the Government's responses to the COVID-19 pandemic loom, it is hard to know what protections and relaxations remain in place for companies and their directors. We summarise the current (as at the week commencing 14 September 2020) stimuli and moratoria implemented by the Federal Government. This accompanies our webinar: Restructuring and insolvency - preparing for, and going beyond, the insolvency cliff, held on 16 September 2020.

Safe harbour

Safe harbour

- Provisions in the Corporations Act introduced in 2017 provides relief from personal liability for debts incurred by directors trading while insolvent in certain circumstances. The relief does not extend to liability for any breaches of a director's statutory or common law duties.

Temporary COVID-19 measures

- In March 2020 the Federal Government provided a 'safe harbour' from insolvent trading liability for any debts incurred 'in the ordinary course of the company's business' until the temporary measure expired.

- This measure was due to expire on 25 September 2020.

- On 7 September 2020 the Federal Government announced it is extending this safe harbour relief until 31 December 2020.

Lift on minimum quantum and period for statutory demands

![]()

Statutory demand

- A document issued by a creditor requiring the debtor company to pay the debt owing or otherwise respond within 21 days. Failure to comply amounts to presumption of insolvency and provides grounds for a creditor to commence proceedings to wind up the debtor company.

Temporary COVID-19 measures

- As with the 'safe harbour' provisions, the Federal Government implemented temporary measures dealing with statutory demands in March 2020.

- The threshold for a creditor to issue a statutory demand has been temporarily increased to $20,000 (normally $2,000).

- The time allowed for a company to respond to a demand has also been increased to six months (normally 21 days).

- These temporary measures were due to expire on 25 September 2020 but have been extended until 31 December 2020.

Relaxation of responsible lending requirements

![]()

- The Federal Government has provided relief from the responsible lending obligations during the six month 'exemption period' (3 April 2020 to 3 October 2020).

- The relief is only available to credit assistance providers, credit providers and lessors, and exempts special purpose funding vehicles that provide credit assistance or credit for a loan or lease for an existing customer that is using the credit for, at least in part, a small business purpose.

Relief for directors from continuous disclosure

![]()

- The Treasurer has provided some temporary relief from continuous disclosure obligations to enable listed companies to more confidently provide earning's guidance, and other forward-looking statements, to the market during the COVID-19 crisis.

- The changes are designed to make it harder for ASIC or third parties to bring a claim alleging a failure to disclose information against companies and officers during the COVID crisis by modifying the test in the continuous disclosure civil penalty provisions in the Corporations Act:

- Ordinary test: an obligation is to disclose non-public information that a reasonable person would expect to have a material effect on the price or value of the entity's securities; and

- Modified test: non-public information need only be disclosed if the entity knows or is reckless or negligent with respect to whether that information would, if it were generally available, have a material effect on the price or value of the entity's securities.

- The net effect of replacing the reasonable person standard with one of knowledge, recklessness or negligence is to require a higher degree of certainty that the forward-looking information would have the necessary market impact, before it must be disclosed under the Corporations Act (for the proposes of civil proceedings only).

- This is a welcome change for directors during this time; however, there are several practical reasons why disclosing entities and their directors and officers should continue to exercise caution in relation to their continuous disclosure obligations, for example:

- the modifications do not apply to other market misconduct rules including misleading and deceptive conduct rules; and

- the unmodified standard continues to apply for certain criminal offences.

- Directors should therefore be cautious in implementing any significant practical changes to existing continuous disclosure policies.

Change in capital raising requirements

![]()

Relief provided by ASIC

- ASIC is providing temporary relief for capital raising, relaxing which listed companies can make 'low doc' offers to investors for placements, rights issues and share purchase plans.

- The temporary relief allows companies to suspend trading for a total of 10 days in the previous 12 months and still use the 'low doc' offer option (ordinarily the limit on days suspended is five days in the prior 12 months).

- Limitation: if more than five of the suspended days in the relevant 12 month period occurred before 19 March 2020, this relief will not be available.

- Without this blanket temporary relief, companies would need to either prepare a prospectus or apply to ASIC for individual relief.

- Directors are still required to ensure the capital raising is in the best interests of the company and to keep the market informed even while suspended.

- ASIC announced on 12 June 2020 that the temporary relief is due to expire on 2 October 2020.

Relief provided by ASX

- Increasing placement capacity to 25%.

- ASX has increased the permitted placement capacity by granting a temporary class waiver from the listing rule that requires any new securities issued to not exceed 15% of a company's capital.

- The waiver allows companies to make a single placement of fully paid ordinary shares for 25% provided the company delivers a follow-on entitlement offer or share purchase plan.

- Allowing 2 consecutive back-to-back (4 day) trading halts.

- This is now allowed for issuers who are considering fundraising options, provided it is requested upfront.

- Previously, this option was only available to issuers regarding the institutional component of a capital raising.

- Relaxing the 1:1 non-renounceable entitlement offer cap.

- Normally when making a non-renounceable rights offer, an issuer is limited to issuing no more securities than the number of securities it holds (ie a ratio of 1:1).

- ASX has granted a temporary waiver of this requirement, allowing entities to notify the ASX they wish to use a substitute ratio and provide an explanation of the applicable circumstances.

- This relief applies to accelerated non-renounceable entitlement offers and traditional non-renounceable rights issues.

- The temporary relief provided by ASX originally expired on 31 July 2020 but has been extended until 30 November 2020.

Status update – Jobkeeper, Jobsaver, Jobseeker

![]()

Extension of relief

- These schemes were meant to expire on 28 September 2020 but have been extended to 30 March 2021.

Change in test for JobKeeper

- The test for the JobKeeper scheme has been changed to require an employer to show a downturn in the actual GST turnover of the business. The required fall in percentages has remained the same.

- Employers will need to show they meet the relevant thresholds using this test for the September 2020 quarter to be eligible for the December 2020 quarter (and again for the December 2020 quarter to be eligible for the March 2021 quarter).

Legacy employers

- Employers who can only show a decline of 10% in GST turnover won't be eligible for the subsidy, but will be classed as a 'legacy employer'.

- Legacy employers can still make certain JobKeeper directions, for example:

- Reduce employees' hours of work (to no less than 60% of the employee's ordinary hours of work); and

- Temporarily change an employee's duties or location of work.

Declining JobKeeper payments

- Payments under JobKeeper are set to start reducing each quarter starting from 28 September 2020 to ultimately end by 29 March 2021.

- The decline in payments mean that employees will be able to also claim JobSeeker, as the amount received is below the relevant threshold for JobSeeker payments.

Partial government guarantees of unsecured loans

![]()

- Under the SME Guarantee Scheme the Government is supporting up to $40 billion of lending to small and medium sized businesses (SMEs) with a turnover of less than $50 million, including sole traders and not-for-profit organisations, with the Government guaranteeing 50 per cent of new loans issued by eligible lenders until 30 September 2020.

- The guaranteed loans up to 30 September 2020 are limited to $250,000 per borrower and to a term of three years.

- From 1 October 2020, eligible lenders will be able to offer loans on the same terms as above, but for a broader range of business purposes, larger loans and over longer periods (five years instead of three years).

HomeBuilder explainer

![]()

- The HomeBuilder grant provides $25,000 to individuals and couples to build or buy a new home, or substantially renovate an existing home that they will own and occupy.

- The contract must be signed between 4 June 2020 and 31 December 2020 and the house must cost less than $750,000 to build or buy or between $150,000 and $750,000 to renovate (so long as the post-renovation value does not exceed $1.5 million).

- The grant is only available for individuals with earnings of less than $125,000 per annum and couples with earnings less than $200,000 per annum.

APRA and bank capital ratio requirements

![]()

- APRA has temporarily relaxed the need for banks to meet the benchmark capital targets it set in 2017.

- Banks currently only need to satisfy APRA that they can continue to meet the minimum capital requirements.

- This effectively reduces the capital requirements:

- For the four major banks – by around 150 basis points; and

- For the other authorised deposit-taking institutions (ADIs) – by around 50 basis points.

RBA cash rate for banks

![]()

- The RBA has made available $140 billion for ADIs to access at a fixed interest rate of 0.25 per cent for three years.

- For every additional dollar of credit an ADI makes available for small or medium sized business this year, the RBA will make available an additional five dollars of funding for the ADI to borrow.

- Similarly, for every additional dollar of credit for large businesses, ADIs will have access to an additional dollar of funding from the RBA.

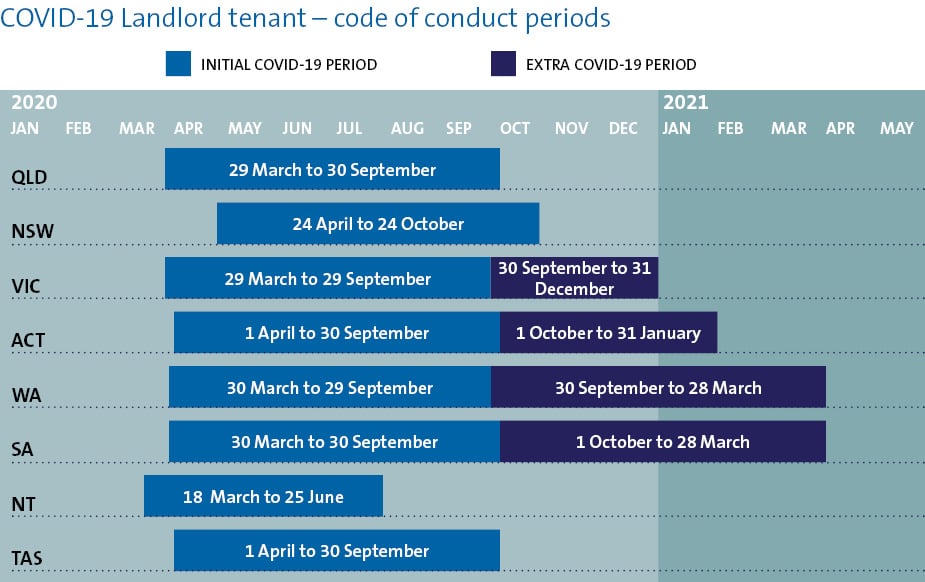

COVID-19 landlord / tenant Code of Conduct

![]()

- The National Cabinet published the Code of Conduct for commercial tenancies on 7 April 2020.

- The Code sets out a framework of mandatory 'good faith leasing principles' for lease renegotiations between landlords and eligible SME tenants, designed to ensure landlords grant impacted tenants appropriate rent concessions, including waivers and deferrals of rents.

- However, the Code has no legal effect on its own; states and territories must give effect to its provisions through relevant state and territory legislation.

- The approaches taken to implement the Code across the nation have not been uniform, and the time periods during which the Code is to apply are not consistent in each jurisdiction.