Key considerations across the legal landscape 11 min read

Following the release of the National Hydrogen Strategy in 2019, Australia is seeing exciting developments in government funding, new project announcements and private sector interest in a hydrogen industry. Federal and state governments are partnering with the private sector to support hydrogen technologies, in the race to become a premier exporter of clean hydrogen to the decarbonised global economy.

This Insight explores the opportunities for Australia to establish a leading hydrogen industry, including recent policy developments, the latest funding announcements and key legal issues to be aware of.

Key takeaways

- There has been an increasingly strong commitment from federal and state governments to fund hydrogen projects around Australia. The private sector is enthusiastically taking up these opportunities.

- The policy landscape for hydrogen production and export in Australia is still in development. Commentators recognise the need for regulatory reform to kickstart a commercial hydrogen industry on a national scale.

- If you are interested in developing or investing in a hydrogen opportunity, now is the time to be aware of the policy, regulatory and practical issues for hydrogen projects. These span development, production, transport, storage and use issues, and will continue to change as regulations and policy evolve.

Hydrogen – what is all the fuss about?

Hydrogen is the world's most abundant chemical, comprising approximately 75% of the earth's mass. It is generally combined with other elements in the natural environment, and must be separated to become a useful product. Once in its refined state, hydrogen has the potential to power everything that petrol or natural gas can, without emitting carbon dioxide. It can be used in sectors that have traditionally been difficult to decarbonise, such as transport and steelmaking.

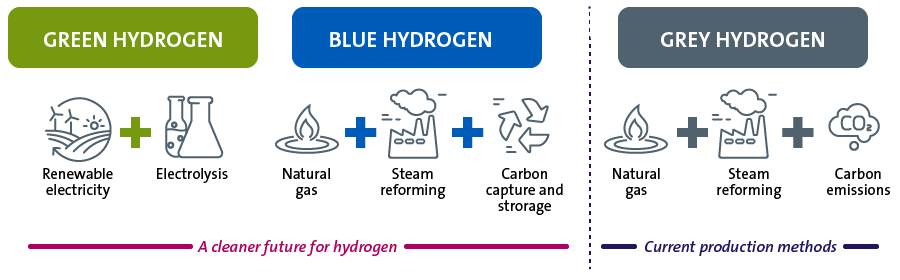

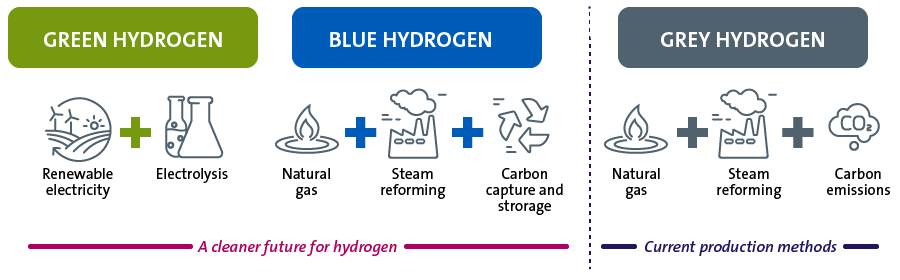

Low carbon options for hydrogen production are attracting significant attention. Currently, hydrogen production is primarily undertaken via steam reforming, where natural gas is reacted with high-temperature steam to create hydrogen, carbon monoxide and carbon dioxide. This is known as grey hydrogen, when carbon emissions are released into the air, and blue hydrogen, when the emissions are captured through carbon capture and storage (CCS) technologies.

Hydrogen can also be produced through electrolysis, where an electric current splits water into hydrogen and oxygen. Where the electricity is produced using fossil fuels, this is also considered a type of grey hydrogen (or blue hydrogen where the carbon emissions are offset). Where electricity is generated from renewable sources, this is known as green hydrogen. As the world shifts to a decarbonised economy and countries work to meet their Paris Agreement targets, green hydrogen will be an increasingly in-demand commodity.

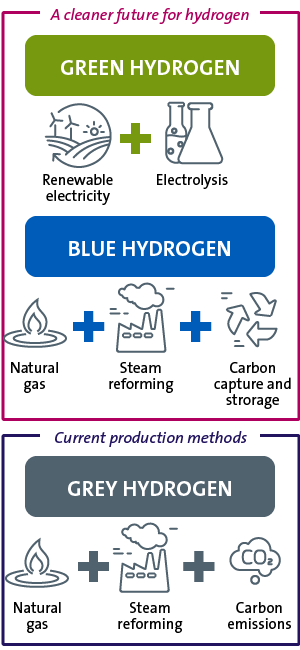

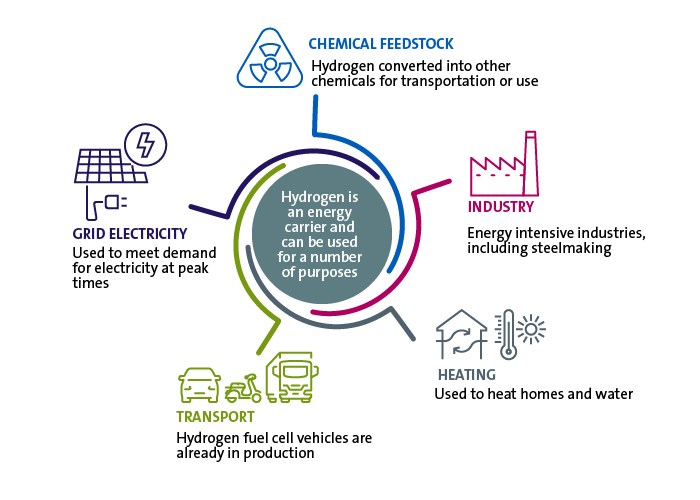

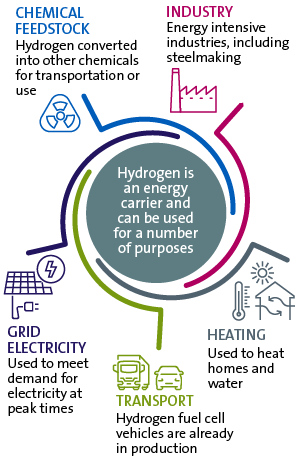

Hydrogen has a range of diverse potential applications, including:

- Industry: energy-intensive industries that are difficult to decarbonise, such as steelmaking, aviation and shipping, can use green hydrogen as a substitute fuel.

- Grid electricity: excess renewable energy from the grid can be used to generate green hydrogen, which can then either be used for other purposes or stored for use at a later point in time. Co-location of renewable energy sources and hydrogen infrastructure allows stored hydrogen to be called upon to generate electricity when the grid is in deficit.

- Chemical feedstock and export: hydrogen is also used as a means of creating other chemicals. Ammonia production has been identified as a viable end product, for its various industrial applications (eg fertiliser production) and as a suitable option for hydrogen export.19

- Transport: vehicles can use hydrogen as a fuel in two ways. Most commonly, electric vehicles use a hydrogen fuel cell that is able to convert stored hydrogen into electricity. Several hydrogen fuel cell vehicles are already on the market. Alternatively, hydrogen combustion engines (based on converted diesel engines) power vehicles in much the same way as existing petrol engines, but only emit water vapour as exhaust. However, the rising proliferation of electric vehicles and difficulties in hydrogen combustion technology have made fuel cells the favoured application for hydrogen in the transport sector.

- Heating: hydrogen burns at a similar temperature to natural gas (2000°C) and can therefore be used in many of the same applications. Domestically, water boilers and radiators can be converted to be fuelled by hydrogen.

Policy developments and what they mean for the industry

Hydrogen policy objectives

State and federal governments have a clearly defined and researched hydrogen policy. The COAG Energy Council released the National Hydrogen Strategy in 2019, which identifies key hurdles and growth areas for the development of a hydrogen industry in Australia. Since then, there has been increasing funding for hydrogen related projects and a crystallisation of the policy priorities for Australia at both federal and state levels. These include:

- Export: Australia aims to establish itself as a leading exporter of high quality clean hydrogen by 2030.1 Australia has already developed ties with export partners in Asia (see our Insight article on Australia's collaboration with Japan) and Europe,2 and aims to use its existing gas export infrastructure to export hydrogen and its derivatives, such as ammonia, to a number of international export partners. Each State and Territory has also committed to supporting the renewable hydrogen industry and prioritising its development.3

- H2 under 2: the Federal Government has set an economic goal to produce hydrogen at or under $2 per kilogram.4 That is understood to be the point where hydrogen becomes competitive with alternative energy sources in large-scale deployment across our energy system. To achieve this, funding has focussed on projects seeking to decrease the cost of electrolysers and scoping locations for the most efficient hydrogen production facilities.5

- Clean hydrogen: both government and industry groups have recognised that Australia must focus on the development of green and blue hydrogen. Global emissions targets and the move towards decarbonisation, mean that the demand for zero or low-emission hydrogen will grow significantly over the coming decades.

- Gas blending: hydrogen can be blended into existing gas networks. Preliminary studies have found that hydrogen can be safely added to gas supplies at up to 10% by volume without having to modify pipelines or appliances.6 The NSW Government aims to achieve 10% renewable hydrogen in the gas network by 2030.7 The National Hydrogen Strategy also aims to have the gas network eventually functioning on 100% hydrogen.

Recent developments in hydrogen project funding

Federal and state governments have recently announced a series of funding commitments to new hydrogen projects around Australia. In April 2021, the Federal Government announced that the 2021-22 budget would include $275.5 million to accelerate the development of four additional clean hydrogen hubs in regional Australia.

See our Hydrogen Technologies timeline for more information on hydrogen in the Federal Budget, and the evolution of federal level funding for hydrogen projects.

An overview on funding:

State Government funding

State governments have also been proactive in funding hydrogen projects. In March 2021, the New South Wales Government announced $70 million from its Net Zero Industry and Innovation Program will be used to fund green hydrogen hubs in the Hunter Valley and Illawarra regions. Similar programs are underway in Tasmania, South Australia, Victoria and the Northern Territory.8 Western Australia announced in January that it received 65 expressions of interest to produce and export renewable hydrogen at the greenfields Oakajee Strategic Industrial Area (SIA). As part of its $50 million renewable hydrogen development funding program, Tasmania is supporting feasibility studies into three large-scale renewable hydrogen projects - two in Bell Bay (Origin Energy and ABEL Energy) and one in Port Latta (Grange Resources) in the north of the state.

Private funding

Privately funded renewable hydrogen projects are also emerging. For example, a consortium of global renewable energy companies plans to develop the Asian Renewable Energy Hub (AREH) in the east Pilbara. The AREH will include 26GW of upstream wind and solar generating capacity, capable of producing approximately 1.8 million tonnes per annum of green hydrogen.9 The AREH recently failed to obtain federal environmental approval and is in the process of addressing some environmental concerns. Two AREH participants have also partnered with local indigenous landowners, the Mirning, with plans to develop the largest green hydrogen hub in the world in the state's south. The Western Green Energy Hub (WGEH), which is yet to obtain approvals, would involve up to 50GW of renewable energy production to power hydrolysers capable of producing up to 3.5 million tonnes of hydrogen per annum.10

Key considerations across the legal landscape

There is no existing legal framework in Australia targeted specifically at hydrogen production projects. Dr Alan Finkel has called for a nationally coordinated regulatory scheme to encourage the growth of hydrogen industries in Australia.11

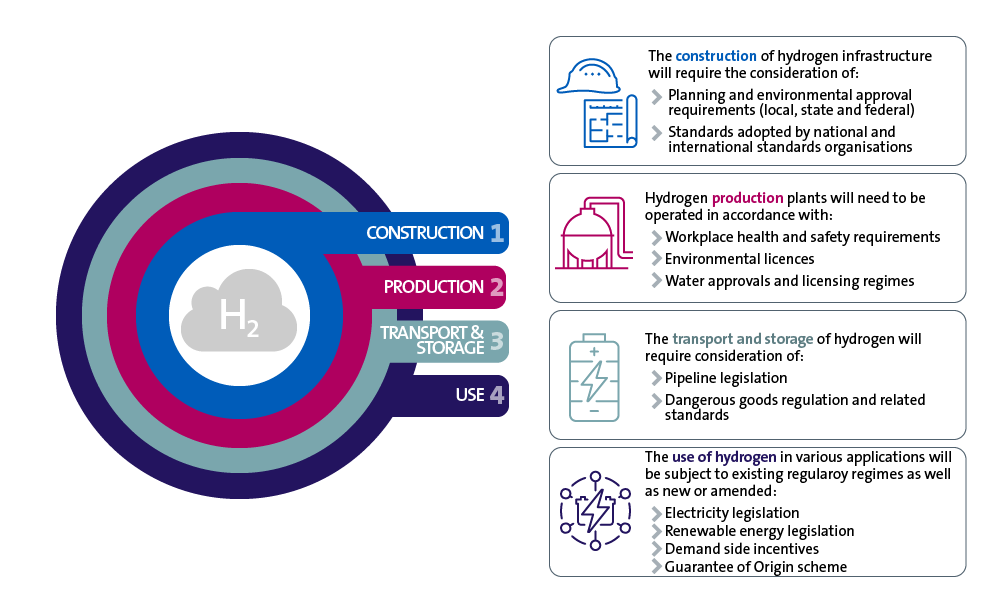

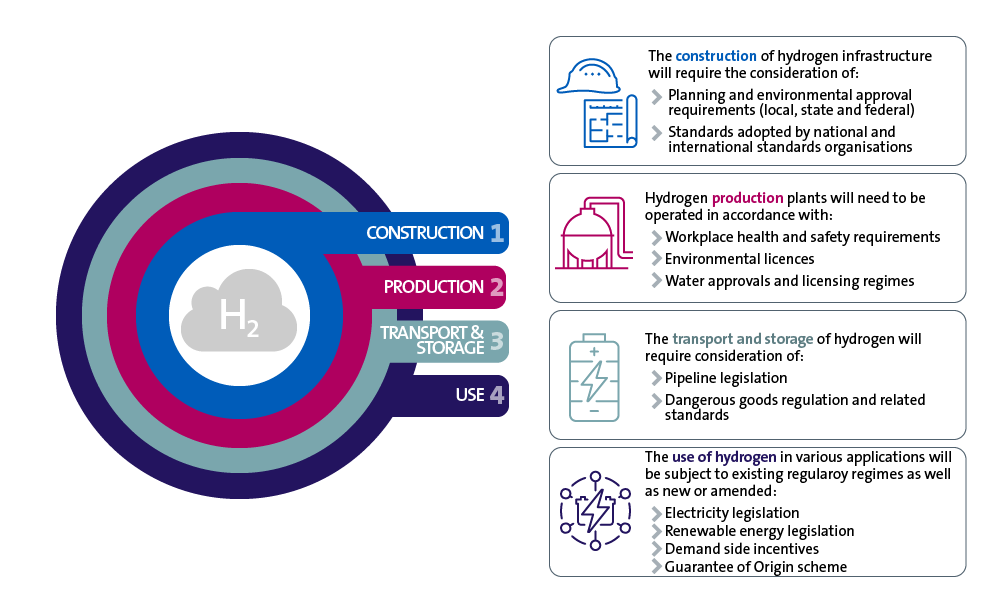

Stakeholders interested in investing in hydrogen should be aware of the existing regulatory landscape. Each stage of a hydrogen project will be subject to various regulatory requirements including for construction, production, transportation, storage and use. In some areas, existing legal regimes are well-adapted to the hydrogen economy. Others, will require reform to facilitate the development and use of hydrogen technology.

A 2019 review for the Department of Industry, Innovation and Science identified 730 pieces of legislation and 119 standards that may be relevant to a hydrogen industry.12 The 2021-22 budget includes $2.4 million to support hydrogen related legal reforms.

Key regimes relevant to the hydrogen industry:

|

|

|

|

Actions you can take now

- Those interested in developing or investing in a hydrogen project should ensure they are up to date with government announcements about funding opportunities, policy development and legislative reforms.

- Project developers should ensure they consider the detailed suite of regulatory requirements and potential uncertainties applicable to new hydrogen projects, and factor this in to project timelines.

- Understand the 'Guarantee of Origin' regime and the potential impacts. Know what the changes mean for you going forward and what other countries are doing in regards to this regime.

Footnotes

-

Department of Industry, Science, Energy and Resources, Australia's National Hydrogen Strategy (November 2019).

-

Angus Taylor MP, Australia partners with Singapore on hydrogen maritime sector (June 2021). Prime Minister Scott Morrison MP, Australia and Germany partner on hydrogen initiatives (June 2021), Dan van Holst Pelekaan MP, Feasibility study on export of SA green hydrogen to Rotterdam (March 2021).

-

Australian Hydrogen Council, Government Policies – Federal and State Policies (July 2020).

-

Angus Taylor MP, Fast Tracking renewable hydrogen projects (April 2020).

-

Australian Renewable Energy Agency, Australia's pathway to $2 per kg hydrogen (November 2020).

-

Sonali Paul, 'Future Proofing: Australia's gas networks look to go green with hydrogen', Reuters (February 2021).

-

NSW Department of Planning, Industry and Environment, Net Zero Plan Stage 1: 2020 – 2030 (March 2020), page 30.

-

National Energy Resources Australia, HyResource: A Short Report on Hydrogen Industry Policy Initiatives and the Status of Hydrogen Projects in Australia (May 2021).

-

Intercontinental Energy, Asian Renewable Energy Hub (July 2021).

-

Intercontinental Energy, Western Green Energy Hub (13 July 2021).

-

Michael Mazengarb, 'Finkel says there is no political will for hydrogen targets in Australia', Renew Economy (December 2019).

-

Clayton Utz, Hydrogen Industry Legislation (November 2019). [Note: Clayton Utz is the author.]

-

Standards Australia, Hydrogen standards release summary (July 2020).

-

ISO, Standards by ISO/TC 197 – Hydrogen Technologies (2021).

-

Sam Bruce, et al., National Hydrogen Roadmap: Pathways to an economically sustainable hydrogen industry in Australia, CSIRO xix (Austl.) (2018).

-

Clean Energy Regulator, Carbon Capture and Storage – Method Development (June 2021).

-

See for example Pipelines Act 1967 (NSW); Gas Supply Act 2003 (QLD); Pipelines Act 2005 (VIC).

-

COAG Energy Council (2019) Issue 4 – Guarantees of Origin.

-

Australian Renewable Energy Agency, Hydrogen to Ammonia Research and Development (March 2021)