Emerging trends in the class action landscape

It is an extraordinarily challenging time for companies to assess class action risk. The landscape is constantly changing and it’s hard to sort the wheat from the chaff.

2019 was characterised by a dip in filings, uncertainty around funding models and increasingly interventionist case management. There has been a significant spike in consumer claims, rising employment claims and a drop-off in shareholder claims.

A proper assessment of class action risk requires a holistic assessment of the broader class action landscape. To provide that broader context, and give practical guidance to those responsible for assessing and managing class action risk, in this latest edition of our Class Action Risk report we have provided an overview of the indicators and drivers of class action risk, with a particular focus on the way in which the class action landscape has changed over the course of the last year.

The future of class action risk

A comprehensive assessment of class action risk involves considering the factors likely to affect the shape of that risk in the short to medium term.

Two particular types of claim will loom even larger in the short term. We will continue to see a steady stream of claims inspired by the issues exposed by Royal Commissions and other regulatory actions, and a likely increase in class actions relating to employment relationships (in the general sense of that term). Our report also explores these new frontiers:

- Data breach: although yet to become a feature of the Australian landscape (unlike in the US), it is only a matter of time before we see more data breach class actions given the increasing focus around data privacy and use

- Climate change and other risks: non-disclosure of material business risks (including in respect of not lowering emissions) as grounds for shareholder class actions

- Systems and controls: shareholder class actions based on something going wrong due to inadequate systems and controls.

Sectors most at risk of class actions

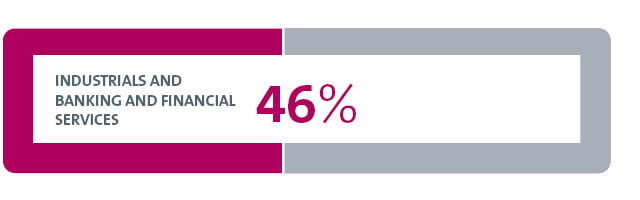

The Industrials and Financial Services sectors combined make up 46% of class action filings since 2017

- Industrials account for 21% of consumer class actions, up from 16% across 2010-2016, reflecting an increased level of product liability class actions;

- Financial services have accounted for 25% of class action filings since 2017, heavily influenced by the Financial Services Royal Commission. Plaintiff lawyers and litigation funders use Royal Commission regulatory materials as a form of 'road map' to identify potential claims.