Surges, setbacks and record highs 5 min read

Trade mark filing data published annually by IP Australia provides valuable insight into market trends that can help inform and shape your trade mark strategy.

The newly released 2025 Australian IP Report (the Report) shows that, overall, trade mark filings in Australia are growing, driven largely by the rise in international applications. In particular, Chinese filings nearly doubled over the past year, while Australian domestic filings fell slightly, by almost 1%. Growth in international filings is concentrated in household goods, clothing and cosmetics, largely fuelled by online marketplaces and e-commerce activity.

In this Insight, we explore the headline statistics and shifting international patterns, highlighting how they are influencing the strategies and behaviour of both domestic and international trade mark applicants.

Key takeaways

- Domestic trade mark filings in Australia are declining, likely due to fewer new businesses and weaker household spending.

- There is a continued trend of decline in trade mark filings from the United States, which reflects the slowdown in IP activity from US innovators.

- A surge in e-commerce activity from China is driving increased trade mark applications for household items. This may signal a rise in counterfeit or 'dupe' goods entering the Australian market.

ANZ trade mark filings by the numbers

IP Australia reported a 2.8% increase in total trade mark filings, reflecting modest but steady growth in overall activity. This trend is similar to that in New Zealand, which experienced a 2.2% rise. In Australia, just over half (56.5%) of filings came from domestic applicants, while the remaining 43.5% were submitted by international entities. By comparison, domestic filings in New Zealand account for a larger share, around 66%, suggesting a relatively stronger domestic contribution to trade mark activity there.

Drivers of growth in Australia

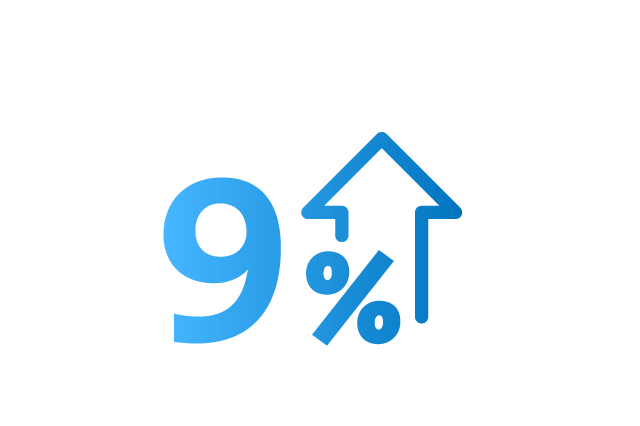

The recent growth in trade mark filings in Australia has been largely driven by international entities, whose applications increased by a total of 9%. Notably, the United Arab Emirates (the UAE) recorded a substantial surge in filings in Australia, rising by 51.7%, while filings from the US declined.

Trade mark filings by non-residents rose by 9% in Australia.

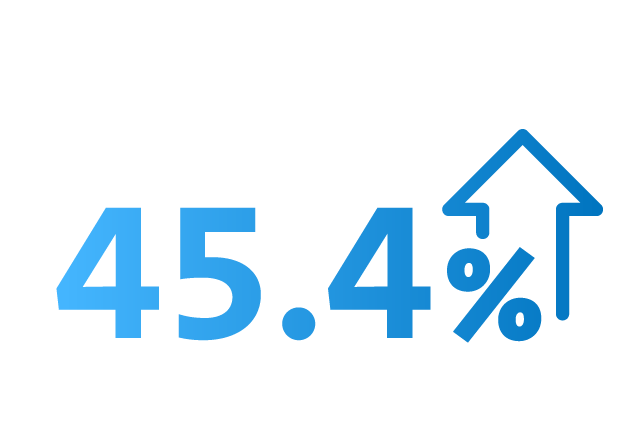

Applications from China almost doubled in the past year in Australia, up 45.4%.

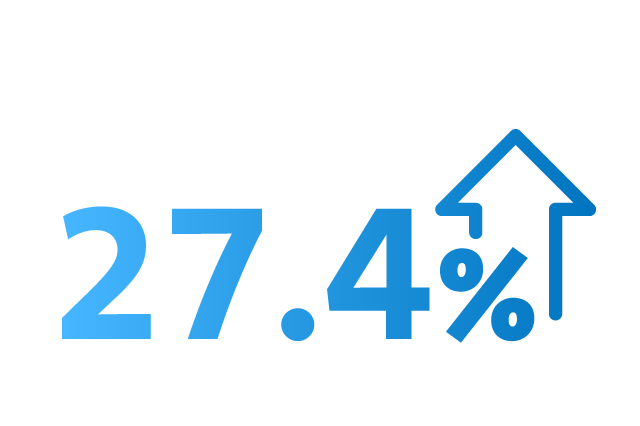

The UK saw applications from China increase 27.4% compared with 2023.

Since trade mark filings often serve as an early indicator of economic activity, these trends suggest stronger economic momentum and business expansion in the UAE, whereas the decline in US filings may reflect slower growth or reduced innovation activity in that region.

Surge in international applications amid local decline

Increased filings from China

Applications from China in Australia have nearly doubled over the past year, rising by 45.4%. This continues a strong upward trajectory that we also saw in 2023 and is consistent with global filing patterns.

According to IP Australia, this surge is being driven by several structural shifts within China's economy:

- significant growth in e-commerce, particularly in household items;

- major advances in science and technology that are reshaping its trade profile; and

- expanding global market share in electric vehicles and related components such as batteries.

Together, these forces are encouraging more Chinese businesses to secure international brand protection as they expand abroad.

By contrast, filings from the US fell by 6.6%, reflecting a slowdown in IP activity from US innovators. This is not an isolated development, as similar declines were also observed in 2023, and have been experienced in the UK, where filings from US applicants dropped 2.6%.

Decline in domestic filings in Australia

Domestic trade mark filings in Australia fell by 0.9%, contrasting with the trend in the UK, New Zealand and the US, where resident filings increased. So, why is this happening ? There are several factors that help explain this decline.

IP Australia notes that Australia's business entry rate dropped to 4.9% after three consecutive years of decline, meaning fewer new businesses are being established and, in turn, fewer brands are being registered. Retail trade filings also fell, consistent with the broader economic slowdown.

At the same time, household spending has weakened under the weight of inflation. Consumers are tightening budgets overall, although demand for furnishings and household equipment remained strong, creating opportunities for international entrants to target Australian consumers through online retail and e-commerce platforms.

In short, slower domestic business creation and weaker household spending are dampening domestic filings, while overseas businesses are capitalising on consumer demand for lower-cost household goods, driving the surge in international filings in the retail sector.

The impact of Chinese e-commerce on growth

According to IP Australia, the surge in e-commerce activity from China has been the main factor behind an 85% rise in trade mark applications for household items in 2024. Specifically, the five classes in the Nice Classification system with the strongest growth were:

- clothing, footwear and headgear;

- furniture;

- household or kitchen utensils and containers;

- non-medicated cosmetics and toiletry preparations; and

- pharmaceutical and veterinary preparations

Companies are increasingly registering trade marks to strengthen their sales on major platforms such as Amazon and Temu, particularly in the market for low-cost everyday products, where customer brand loyalty tends to be low. This surge in filings has also prompted concerns that it may signal a rise in counterfeit or 'dupe' goods entering the Australian market.

IP Australia observed that other jurisdictions, such as the US, have experienced rapid growth in trade mark filings from China over the past decade. In 2023, Chinese filings accounted for 45.5% of all international filings in the US, underscoring the global scale of this trend.

Actions you can take now

All applicants

All brand owners must be prepared by having a robust counterfeit strategy to address low-cost and 'dupe' or counterfeit products entering the Australian market.

Domestic applicants

Increased competition from overseas entrants makes it essential to have effective strategies in place for protecting your brands.

International applicants

Overseas entrants need to clear marks before launching in the Australian market. A number of overseas businesses have found themselves facing trade mark infringement lawsuits as a result of failing to clear their marks before launch.

If you would like to discuss the issues raised in this Insight or require assistance, please contact any of the people below.

Explore further

INSIGHT

Enforcing IP against AI training across borders: UK guidance, Australian context

10 Dec 2025