Cases by the numbers

Insurance misconduct enforcement cases in progress

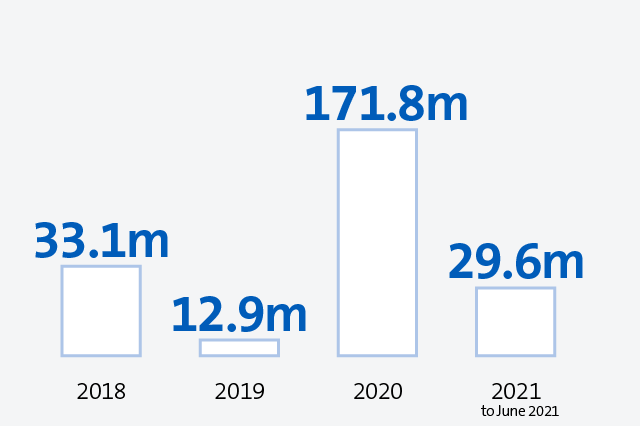

Civil penalties imposed by the courts as a result of ASIC proceedings

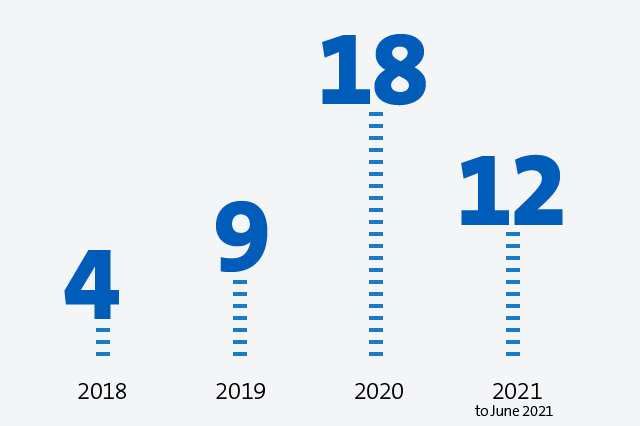

Civil penalty proceedings commenced by ASIC

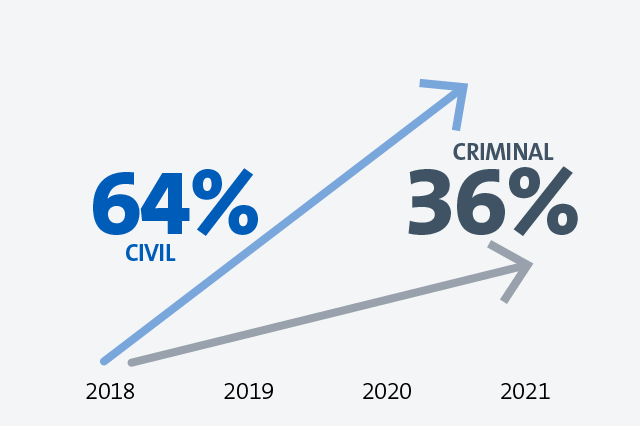

Increase in civil proceedings and in the number of criminal proceedings brought by ASIC

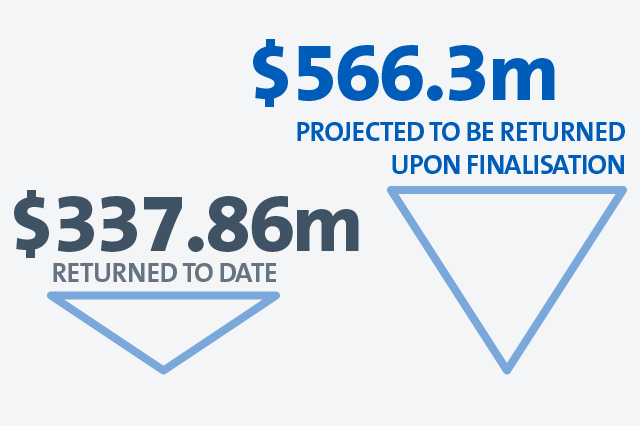

Value of ASIC's active general insurance remediations

Increasing regulatory risk for insurers

In the wake of the Financial Services Royal Commission, there have been a series of legislative reforms that considerably increase the regulatory burden and risks faced by insurers in carrying out their day-to-day role of selling insurance products and managing claims.

Trend of increasing regulatory risk

| 14 December 2017 |

| The Financial Services Royal Commission is established. |

| 18 December 2017 |

| The ASIC Enforcement Review Taskforce Report recommends an expansion of the civil penalty regime to include certain provisions of the Insurance Contracts Act. |

| 1 February 2019 |

| Commissioner Hayne delivers the Final Report of the Financial Services Royal Commission, which makes adverse findings against insurers and recommends strengthening ASIC's enforcement powers. |

| 12 March 2019 |

| Civil penalties for contraventions of the duty of utmost good faith may apply to conduct occurring after this date (being the date on which the Treasury Laws Amendment (Strengthening Corporate and Financial Sector Penalties) Act 2019 (Cth) received Royal Assent). |

| 26 November 2020 |

| The Federal Court delivers judgment in ASIC v Youi Pty Ltd [2020] FCA 1701, following a Financial Services Royal Commission case study, in which the insurer is found to have breached its duty of utmost good faith. |

| 1 January 2021 |

| The Financial Sector Reform (Hayne Royal Commission Response) Act 2020 (Cth) amends the Corporations Act definition of 'financial service' to include a 'claims handling and settling service'. |

| 23 February 2021 |

| Following a referral from ASIC, criminal charges are laid against Allianz and AWP Australia for allegedly making false or misleading statements regarding the sale of Allianz's domestic and international travel insurance products. This follows separate civil proceedings launched in September 2020. |

| 9 March 2021 |

| TAL is found to have breached its duty of utmost good faith in the Federal Court's judgment in ASIC v TAL Life Limited (No 2) [2021] FCA 193 – another test case brought by ASIC following a recommendation from the Financial Services Royal Commission. |

| 5 April 2021 |

| The unfair contract terms regime is extended to many standard form insurance contracts that were entered into or renewed from this date, following passage of the Financial Sector Reform (Hayne Royal Commission Response – Protecting Consumers (2019 Measures)) Act 2020 (Cth). |

| Present |

| Increased community and regulatory focus on claims handling processes and outcomes following a wave of natural disasters and the COVID-19 pandemic. |

| Future |

| Further regulatory burdens for insurers on the horizon as a result of changes to anti-hawking laws, deferred sales requirements for add-on insurance, the new Design and Distribution Obligations regime, an updated breach reporting regime and the revised General Insurance Industry Code of Practice 2020 (all of which come into effect in the second half of this year). |