Unpacking sustainable finance products

The characteristics of these finance products are becoming increasingly standardised by the participants in the loan markets and market practice, rather than by regulation.

In the last two years APLMA together with the UK-based Loan Markets Association (LMA) and the US-based Loan Syndications and Trading Association (LSTA) have jointly developed and published guidance for sustainable finance products by way of the Green Loan Principles (GLP), the Social Loan Principles (SLP) and the Sustainability Linked Loan Principles (SLLP). More recently, on 5 August 2021, the same organisations jointly published a revised Sustainable Lending Glossary of Terms which seeks to promote the development and use of a common language surrounding green and sustainable lending globally.

While green loans, social loans, and sustainability linked loans are often collectively referred to as 'green loans', it is important to note that they are different products and are governed by different principles. The defining feature of a true green or social loan is that the proceeds are used for a green or social purpose (as applicable). On the other hand classification of a sustainability linked loan does not depend on how the proceeds are used – the key feature is that pricing is tied to the borrower’s performance against certain predetermined sustainability criteria. Where money borrowed under a sustainability linked loan is being used for a particular purpose, the loan may be certified as a green or social loan in addition to its sustainability-linked certification.

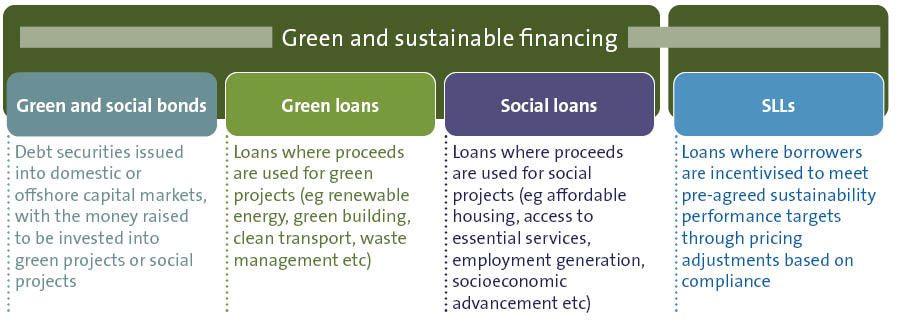

Green and sustainable financing comes in varying forms, shown in the diagram below.

Green loans

Green loans are defined in the GLP as 'any type of loan instrument made available exclusively to finance or re-finance, in whole or in part, new and/or existing eligible Green Projects'.

A 'Green Project' is any project falling within the non-exhaustive categories of eligibility set out in the GLP (which include renewable energy, energy efficiency, pollution prevention and control and clean transportation). The key determinant for qualifying as a 'Green Project' is that the project being financed should provide clear environmental benefits.

Green loans must align with the four core components of the GLP, being the use of proceeds, the process for project evaluation and selection, management of proceeds and reporting.

Social loans

Under the SLP, social loans have the same definition and core components as green loans, except that the proceeds must fund eligible 'Social Projects' rather than Green Projects. Social loans aim to facilitate and support economic activity that mitigates social issues and challenges, and/or to achieve positive outcomes. Eligible projects include affordable basic infrastructure, access to essential services, affordable housing, employment generation, sustainable food systems and socioeconomic empowerment.

Sustainability Linked Loans (SLLs)

SLLs are defined in the SLLP as:

'…any types of loan instruments and/or contingent facilities (such as bonding lines, guarantee lines or letters of credit) which incentivise the borrower’s achievement of ambitious, predetermined sustainability performance objectives. The borrower’s sustainability performance is measured using sustainability performance targets (SPTs), as set against key performance indicators, external ratings and/or equivalent metrics and which measure improvements in the borrower’s sustainability profile'.

SLLs involve an adjustment to pricing based on a Borrower's performance against particular sustainability performance targets. As a result, SLLs contain a more rigorous set up, reporting and compliance regime than green or social loans.