Understanding growth and the incentives for borrowers and lenders

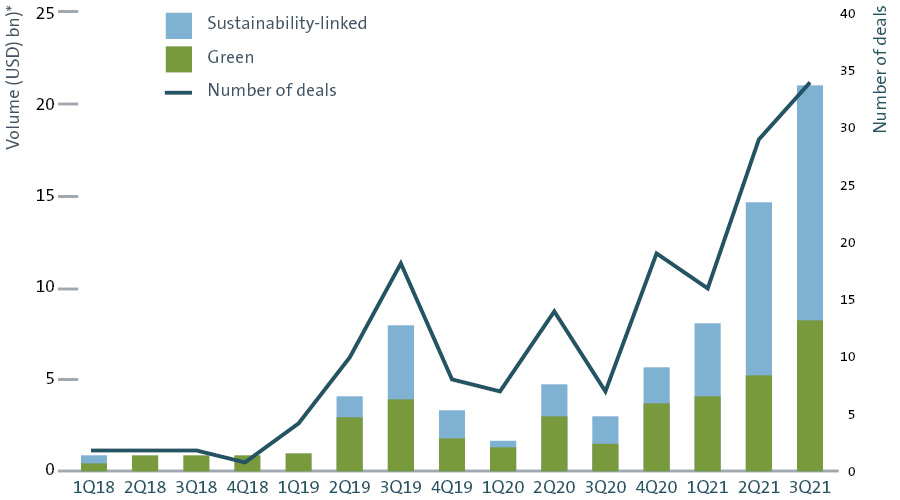

The recent growth in this market has been dramatic – we are seeing the use of green finance being raised on new financings or refinancing of existing debt more, and more frequently. A total of $9.85 billion was raised in the Australian sustainable debt market in 2020,1 and we are experiencing an equally buoyant market for green financing in 2021, with $11.3 billion in green and sustainable finance already issued in Australia as of September 20212 and further growth in the Asia Pacific in 3Q21, as shown in the graph below.

Debtwire par, 'Asia Pacific (ex-Japan) Loans League Table Report 9M21' dated 4 October 2021, page 24.

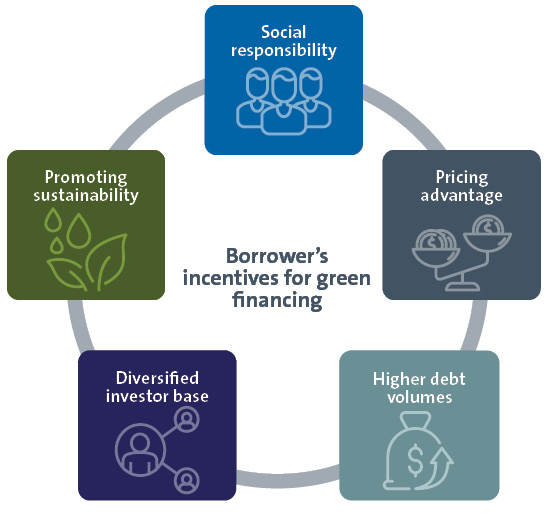

While there is no single driver for the marked increase in green and sustainable finance, borrowers, lenders and investors have been incentivised to explore green and sustainable financing due to the following drivers.

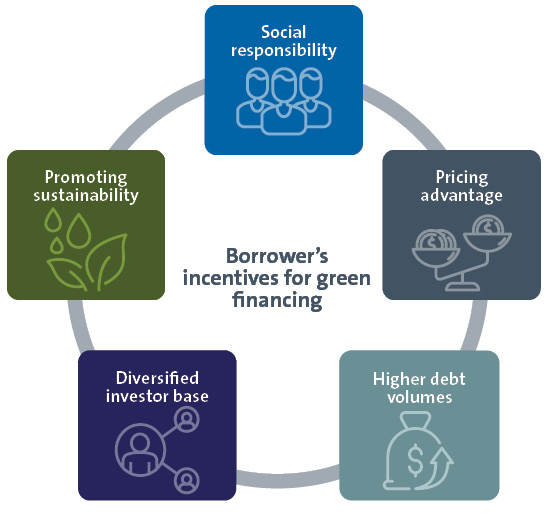

The incentives for corporate borrowers

- Social responsibility and promoting sustainability: green finance is one of the ways Australian corporates are working towards embedding positive environmental and climate change strategies within their businesses. This is particularly relevant due to international pressure on Australia to transition to a low carbon economy in line with global expectations. Many corporates have made commitments to reduce their carbon footprint in line with such goals, though typically ESG policies will encompass a range of other objectives including diversity, community engagement, social initiatives and improved internal governance practices. The establishment of green financing is also an opportunity to make a public commitment in relation to the company's ESG ambitions, helping build its 'social licence' to operate.

- Pricing and volume advantage: while green loans and social loans do not typically have an ongoing pricing adjustment mechanism, the incentive-based structure of SLLs allows borrowers to benefit from a reduced margin if their sustainability performance targets are met over the life of the loan. Borrowers are also reporting that the appetite from lenders for green and sustainable loans is driving offers of higher debt participations from lenders which anecdotally may translate into more competitive pricing and terms at loan establishment (if the loan is oversubscribed).

- Diversified investor base: sustainable finance products attract a broader investor base for the issuance than usually available to corporates, as they are typically held by institutional investors with mandates to invest in green projects.

The incentives for lenders

- ESG strategy and risk mitigation: prudent financiers have identified that borrowers adopting sustainability principles or investing in green projects are more likely to be better prepared for future risks and opportunities, and less exposed to such factors as stranded asset risk or loss of social licence. So they may be assessed as a better credit risk. A quick look at the newspaper headlines reveals it is often ESG-related issues that can have significant adverse impacts for corporates, particularly high-profile companies.

- Bank and investor green lending targets: there is a significant and growing supply of credit and investment capital looking to get exposure to green and sustainable investments. This is being driven by pressure from stakeholders of banks and investors to boost the ESG credentials within their own organisations. Participation in green loans, social loans and SLLs can assist banks to meet their own ESG objectives.

- Disclosure laws: although there is yet to be regulation in Australia, there are moves towards mandatory disclosure regimes relating to sustainability in the UK and European markets. For example, the UK plans to take a phased approach to making climate-related disclosures mandatory by 2025 for corporates, banks, asset managers and pension schemes. In the EU, asset managers and other financial market participants will need to disclose sustainability data under the Sustainable Finance Disclosure Regulation.

- Favourable capital treatment: changes to the regulatory capital treatment of green and sustainability-linked loans are in contemplation at both a European and UK level. While we are not aware of this being considered at present in Australia, many lenders active in the Australian market are also active in the UK and European markets and may be preparing for similar developments in the local market.

- Market positioning: as well as participating in green financing as a lender, financiers are using green finance products as a marketing opportunity with borrowers. Financiers are seeking to deepen their client relationships by taking on the role of 'green loan coordinator' or 'sustainability coordinator' for the financing, for which they may be paid a small additional fee or simply obtain the arranging role and/or higher allocations in the loan.

Footnotes

-

Refinitiv

-

Australasian sustainable debt: fertile ground awaiting growth, KangaNews, https://www.kanganews.com/news/14172-australasian-sustainable-debt-fertile-ground-awaiting-growth