The delivery of quality infrastructure and services remains critical to Australia's economic development.

Australia's infrastructure needs are changing under the weight of technological advancement and demographic shifts. As our cities grow, so must our infrastructure pipeline.

The challenge for the infrastructure sector is to become more efficient and more creative in an environment of unprecedented demand. Success requires collaboration, innovation and drive.

How we can help

Working with commercially focused lawyers is essential to create and manage infrastructure that delivers long-term value and superior service outcomes.

Succeed at every stage of the lifecycle by drawing on the best quality solutions

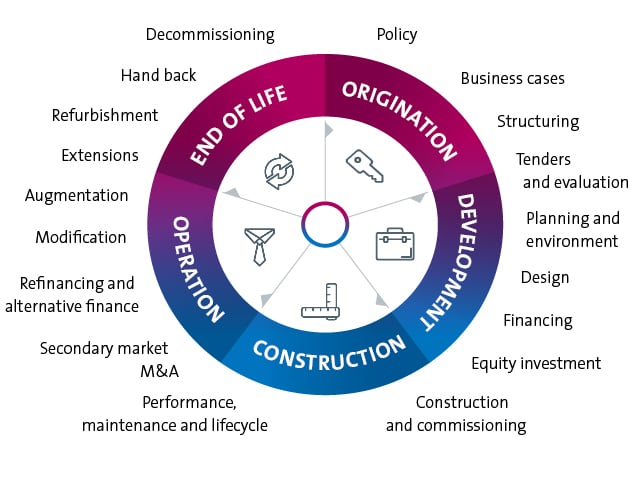

We work with clients throughout the full lifecycle of their infrastructure projects, from origination (policy advice, business case development, tenders and evaluation, structuring and pay, financing, equity investment and secondary market M&A) to construction and development (design, construction and commissioning), to operation (performance, maintenance, refinancing and alternative finance, augmentation and modification) and end of life (handback, decommissioning and refurbishment).

Achieve the outcomes you want through a well-managed process

By balancing technical skills with deep market knowledge and experience of complex, multi-party projects, our solutions go beyond your immediate requirements to future-proof the life of your transaction.

Access the right market insight to help you overcome hurdles and deliver fast outcomes

Stability and depth of talent allow us to learn from the most cutting-edge projects in the market, retaining and building on that knowledge for the life of your infrastructure project.

Experience

North East Link

Advised the Spark Consortium on the successful close of Australia's largest Public Private Partnership, North East Link.

Footscray Hospital

Advised Multiplex on the successful close of the $1.5 billion New Footscray Hospital Project.

Sydney Airport

Advised on the $32 billion proposed acquisition of Sydney Airport by IFM led consortium.

Igneo Infrastructure Partners acquisition

Advised global investment manager Igneo Infrastructure Partners on the acquisition of Elliott Green Power Australia through Igneo's Australian renewables business, Atmos Renewables.

Sydney Metro PPP

Advised the Northwest Rapid Transit consortium on the financial close of the $3.7 billion public private partnership for the next stage of Australia's biggest public transport project, Sydney Metro.

Australia's first waste-to-energy facility

Advised on the financing of Australia's first commercial-scale waste-to-energy facility in Kwinana, Western Australia, which has reached financial close.

Sale of WestConnex - fuelling the growth of NSW

Advised NSW Government on the disposal of its 51% interest in the WestConnex Toll Roads. This was a highly complex multi-stage transaction. The funds raised from the sale can be redirected to other critical infrastructure.

Fulham prison expansion

Advised The GEO Group Australia on the expansion of the Fulham Correctional Centre in Sale, Victoria.

$1.6bn consortium acquisition of PEXA

Advised Morgan Stanley Infrastructure Partners (alongside consortium members Link Administration Holdings Limited and Commonwealth Bank of Australia), on its proposed acquisition of Property Exchange Australia Limited, the national real estate transaction settlements exchange.

Western Roads upgrade

Advised the Netflow Consortium on its preferred respondent nomination for the Victorian Government's $1.8 billion Western Roads upgrade. The project is the first road maintenance project to be delivered in Australia through an availability-payment-style public private partnership.

Melbourne Metro Tunnel

Advised the financiers to the Cross Yarra Partnership on the successful close of the Metro Tunnel Package and related packages of the $11 billion Melbourne Metro Project.

Snowy Hydro 2.0 Expansion Scheme

Advised on all aspects of the $4 billion Snowy Hydro 2.0 Expansion Scheme. Our work has included advice on all aspects of the funding, construction, environmental planning and real estate aspects of the project

WestConnex

Advised Sydney Motorway Corporation on Australia’s biggest road infrastructure project. Allens advised on delivering Stage 1, the widening and extension of the M4 motorway in the west, and Stage 2, duplicating the M5 East in the southwest.