In general

As of January 2019, 336 PPP projects were implemented in Vietnam, with total investment capital of more than VND1,600 trillion (c. USD 69 billion)1. Most of these projects were carried out using either the BOT form (42%) or build transfer (BT) form (56%). A considerable majority (220 projects; approximately 65% of the total number) were in the transport sector – primarily roads. The next most common sector was power, with 19 projects.

Below, we provide a snapshot of the current status of the following key infrastructure sectors: power, gas, roads, ports, airports and petrochemicals.

Power

In Vietnam’s power sector, private sector investment has been carried out in either the PPP form (primarily using BOT structures) or as independent power projects (IPPs) outside of the PPP regulations. In recent years, there has been significant foreign investment in renewable energy, either through direct IPP investment or from the acquisition of existing assets from local developers.

An energy project can only be developed if it has been included in a 'power development master plan'. In line with the Law on Planning, there is a national power development master plan. Each province also has a provincial master plan, with a section on power complementing the national plan. While both plans need to be approved by Vietnam's PM, the national power development master plan is developed by the Ministry of Industry and Trade (the MOIT). Provincial master plans are developed by each province and appraised by the Ministry of Planning and Investment (the MPI).

The current approved national power development master plan is the PDP7 (revised), which covers the period from 2011 to 2020 with a vision to 2030. The next national power development master plan (the PDP8) is currently being drafted. The PDP8 will establish the direction of power development from 2030 up to a vision of 2045. Following Vietnam's announcement at COP26 of a 2050 net-zero emissions target, the Government has requested the MOIT to collect more opinions from experts, scientists and localities to make PDP8 fit for purpose. While the issuance date is unknown, it is expected in Q1 of 2022.

According to the most recent draft of the PDP8 (November 2021), the total installed capacity must be capable of meeting the maximum power demand of Vietnam as a whole. However, the currently planned development pipeline is not compatible with the consumption and supply growth within each of the Northern, Central and Southern regions.

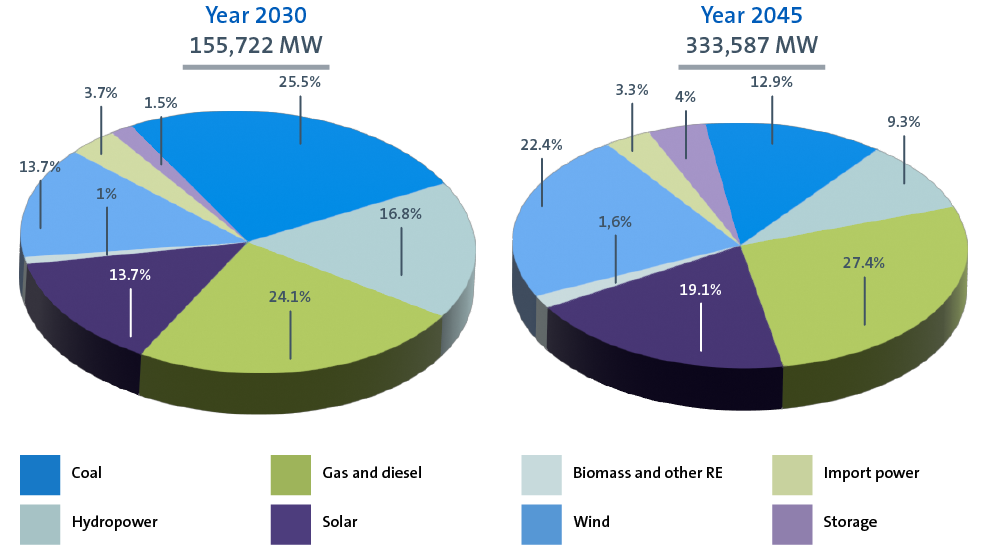

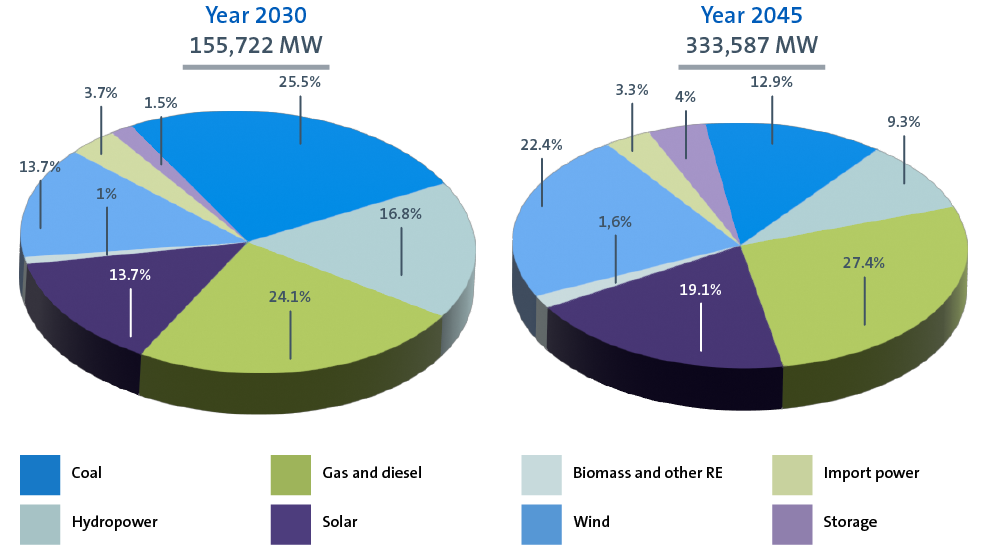

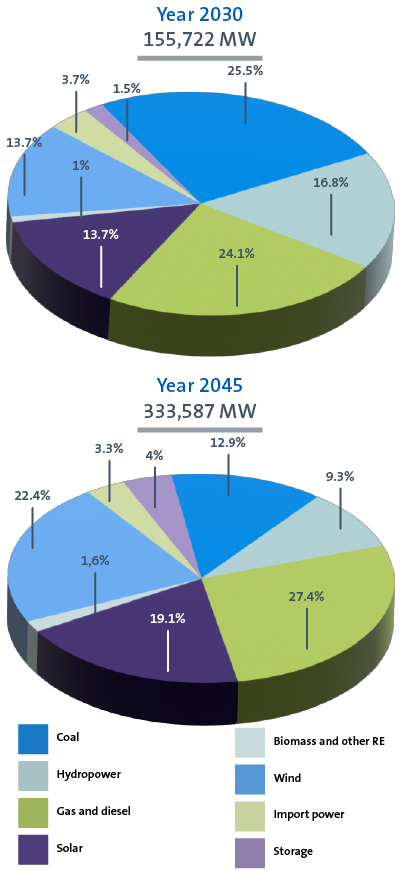

The growth in demand in the north is the highest (around 9.3% per year for the 2016-20 period) while supply-side growth is the lowest among the regions at 4.7% per year.2 The demand and supply-side growth for the same period in the centre is 5.3% and 16% per year, and in the south, 6.8% and 21% respectively.3 This incompatibility between demand and supply is driving specific policies for the development of particular power sources and the approach to transmission in each of the regions. In line with the November 2021 draft of the PDP8, the national total installed capacity is expected to reach around 155,722 MW by 2030 and 333,587 MW by 2045.

We have set out the allocation of power sources in the chart below.

Currently, only two BOT gas-fired power plants (Phu My 2.2 (715MW), Phu My 3 (720MW)) and four BOT coal-fired power projects (Mong Duong 2 (1,240MW), Vinh Tan 1 (1,240MW), Hai Duong (1,200MW) and Duyen Hai 2 (1,320MW)) are in operation. Nghi Son 2 (1,200MW), Van Phong 1 (1,200MW) and Vung Ang 2 (1,200MW) coal-fired power projects have achieved financial close and are currently under construction.4

Despite the instruction from the Politburo in Resolution 55, and Vietnam's net-zero announcement, the planned installed capacity for coal-fired power plants in the November 2021 draft of the PDP8 remains high – 39,699 MW by 2030 and 43,149 MW by 2045 for the high-load case, which accounts for 25.49% and 12.9% of the total national installed capacity respectively.5 However, these figures have been reduced from 40,899 MW by 2030 and 50,949 MW by 2045, which accounts for 28.43% and 15.5% respectively, as set out in the draft PDP8 released in October.6 It remains to be seen how much new coal-fired power capacity will ultimately be able to be financed and constructed.

| 2030 | 2045 |

|---|---|

|

155,722 MW |

333,587 MW |

Currently, seven IPP projects with a capacity of more than 100MW are being implemented, with a total capacity of more than 2,000MW. Two of these – the coal-fired Thang Long project (Quang Ninh province, total capacity of 2x300MW) and the An Khanh project (Bac Giang province, total capacity of 650MW) – are operational. IPP projects are developed on very different terms from PPP projects. Importantly, there is no clear regulatory pathway for investors to seek government guarantees (such as EVN credit support or currency conversion guarantees). In practice, it is also very difficult for IPP investors to obtain such guarantees.

As we analyse in more detail elsewhere in this Report, there are considerations to be taken into account for both PPP and IPP forms (post the PPP Law taking effect), before deciding on the investment form for a project.

Under the law, large-scale renewable energy projects can be carried out in PPP form. However, none have taken this route so far. All have been in line with legal instruments specifically issued for renewable energy investments.

The PDP7 sets out a target for increasing wind power capacity to about 2,000MW by 2025, and solar power capacity to about 4,000MW by 2025 and 12,000MW by 2030.7 In the November 2021 draft of the PDP8, the capacity for solar power has been increased to 21,390 MW by 2030 and 63,640 MW by 2045.

However, solar power capacity will be "re-evaluated" as solar has limited operating time, and Vietnam has not yet developed a viable energy storage system. In the November 2021 draft of the PDP8, there is more focus on onshore and offshore wind power. The capacity for onshore wind power is 17,338 MW by 2030 and 38,838 MW by 2045, and for offshore wind power, 4,000 MW by 2030 and 36,000 MW by 2045.8

For more information on renewable projects, you can see our renewable energy publication here. You can find the offshore wind report here.

Developing gas and LNG-fired power projects is central to Vietnam's planning for baseload supply. The capacity for LNG-to-power is expected to increase in PDP8 to offset the reduction in coal-fired power.

In line with the November 2021 draft of the PDP8, the capacity for LNG-to-power is planned to be 22,400 MW by 2030 and 55,750 MW by 2045 (excluding capacity of planned coal-fired power plants proposed to be converted to LNG-to-power which will remain unchanged at 14,783 GW by 2030).9

For more information on LNG-to-power projects, see our LNG sector update (PDF 995kb).

Roads, ports, airports and rails

As noted above, transportation projects account for a significant majority (65%) of the total number of PPP projects implemented, or set to be implemented, in Vietnam to date. Of the 220 transport sector PPP projects, 132 (60%) are already in operation, with the rest at various stages of development.10

These projects have been mainly carried out in BOT and BT forms, the vast majority (96%) being road projects.

The Vietnam Government is keen to accelerate the development of expressways. For the period 2021 to 2030 with a vision to 2050, it aims to have 41 expressways with a total length of 9,014 kilometres across Vietnam.11

To date, despite substantial interest, there has been limited involvement of foreign investors in road projects (no road projects are wholly-owned and/or operated by foreign investors, and only one has any substantial foreign investment). Foreign involvement is typically limited to providing services and financing.

According to the current seaport master plan,12 the key objectives for the period until 2030 include the development of a port system capable of handling up to 1,423 million tons of goods and 10.3 million passengers. Another priority is the development of international gateway ports and large-scale ports servicing national and inter-regional socio-economic development.

The north has been particularly hampered by a lack of deep-water ports capable of handling modern large-scale ships. However in May 2018, the Haiphong International Container Terminal (HICT) deep-water port in Lach Huyen, Hai Phong opened for business.13

HICT is capable of accommodating large container ships, reducing the need for trans-shipments in northern Vietnam and allowing direct shipping between northern Vietnam and US and EU markets. The second phase of the port was expected to be completed by 2020, but currently remains under development.

In the centre of Vietnam, major ports are located in Quy Nhon and Da Nang, the latter being a deep-water port. There is also a proposal for the development of a seaport in Lien Chieu, Da Nang, in the PPP form.

In August 2020, Trung Nam Group held a groundbreaking ceremony for the construction of Ca Na general seaport in Ninh Thuan province (phase 1), with a designed capacity of 3.3 million tons of goods per year.

In the south, Ho Chi Minh City has a network of ports, with Saigon Port currently the 26th-largest container port in the world and the fifth-largest in ASEAN.

For more information please see our Vietnam port sector overview (PDF, 720KB).

For viable aviation infrastructure projects, the Government encourages investment in the PPP form. However, aviation sector investors face a number of challenges, including cumbersome and opaque government approval processes.

According to public information on the latest draft master plan for airports submitted to the Prime Minister, Vietnam will have 28 airports in total by 2030 – 14 international and 14 domestic (including 22 existing airports and the six new airports Long Thanh, Na San, Lai Chau, Sa Pa, Quang Tri and Phan Thiet).

By 2050, there will be 31 airports – 14 international airports (Hanoi's Noi Bai airport will be expanded to have three runways by 2030 and four runways by 2050, accommodating 100 million passengers) and 17 domestic airports (including another airport in the southeast of Hanoi in the 2030-50 period to ease the pressure on Noi Bai).

In the south, stage 1 of the Long Thanh airport commenced in January 2021 and is expected to be completed in 2025, and expanded by 2050 to have four runways and terminals for 120 million passengers. Da Nang airport will be expanded to have three runways and terminals for 40 million passengers by 2050. Tho Xuan airport in Thanh Hoa is expected to have two runways for 10 million passengers by 2050.

The Ministry of Transport (the MOT) recently proposed using private capital in the PPP form for new airports such as Quang Tri, Sa Pa and Cao Bang.14 The MOT has also proposed mobilising more private capital for aviation services and development of smaller airports outside the PPP form.

The plan for the expansion of Dong Hoi airport in the central province of Quang Binh is expected to be implemented between 2021 and 2025, with a total capital of VND2,320 billion (more than USD 100 million). The PM issued the investment policy approval on 21 October 2021 for the Sa Pa airport in the PPP form.

Meanwhile, an airport in Quang Tri with the capacity for one million passengers a year has been approved in principle by the MOT, with infrastructure conglomerate T&T Group reportedly carrying out a pre-feasibility study (pre-FS).

Other private enterprises, such as Vietjet, Vingroup and Imex Pan Pacific Group, have already shown interest in investing in airports.

In 2018, the Standing Committee of the National Assembly passed a resolution15 approving the investment of VND 15,000 billion (c. USD 644 million) of state budget funds for the 2016-20 period in important and urgent railway and road projects.

Despite this apparent support, there has been a general lack of enthusiasm from and involvement of foreign investors in the railway sector to date. There are various reasons, including that private investors can only invest in infrastructure that is not directly related to operating trains, such as stations/terminals and warehouses.16

In 2020, the PM directed the MOT to create a strategy for the development of railways in Vietnam up to 2030 with a vision to 2050. The focus will be to improve existing railway routes such as the Hanoi – HCMC and Lao Cai – Hanoi – Haiphong routes, as well as develop urban railway systems. Studies will be conducted to consider the construction of new railways connecting large seaports, industrial zones, tourism areas, highland provinces, the Mekong Delta, and international routes.

A pre-FS for a new express north-south route (1,559 km) was completed in July 2019. That project is planned in two phases:

- Phase 1 will cover the Hanoi – Vinh and Nha Trang – HCMC segments being built before 2030.

- Phase 2 will cover the Vinh – Nha Trang segment being built by 2040. However, the pre-FS only considered high-speed passenger transportation and, in January 2021, the MPI requested that the MOT adjust the plan to provide for lower-speed passenger and freight transportation.17

In terms of urban projects, master plans18 provide for eight metro lines in each of Hanoi and HCMC, and three additional tramways or monorails in HCMC. Currently, two are under construction in HCMC, though significantly behind schedule due to EPC, fund disbursement and site clearance issues.

In Hanoi, the Cat Linh – Ha Dong line (13.1 kilometres being constructed by a Chinese contractor) was completed and put into operation in 2021, while the Nhon – Hanoi Railway Station line (12.5 kilometres being constructed by French contractors) is under construction.

The lines in HCMC are Ben Thanh – Suoi Tien (19.7 kilometres invested by the HCMC People's Committee with funding from JICA) and Cu Chi – Thu Thiem (48 kilometres invested by the HCMC People's Committee with funding from ADB, KfW and EIB). Metro line No. 5 from Bay Hien crossroad to Sai Gon bridge – phase 1 (8.9 kilometres) is also at an early stage of development.

Refinery/Petrochemicals

Vietnam currently has two large operational refineries:

- The Dung Quat Oil Refinery in Dung Quat Economic Zone, Quang Ngai. It was developed by PetroVietnam with total investment capital of about USD 3 billion, and a capacity of 8.5 million tons per year.

- The Nghi Son Refinery in Nghi Son Economic Zone, Thanh Hoa. It was developed by four sponsors (PetroVietnam, Idemitsu Kosan Co. Ltd., Mitsui Chemicals Inc. and Kuwait Petroleum Europe B.V.) with total investment capital of more than USD 9 billion and a capacity of 10 million tons per year.

In addition, the Long Son petrochemical complex is under construction in Ba Ria – Vung Tau province. This project has total investment capital of around USD 5.4 billion, with the sole investor being the SCG group from Thailand.

The Vietnamese Government has indicated it aims to attract more investment in the refinery and petrochemical sectors to increase its value-add processing activities, and improve the quality of petroleum products. In all, Vietnam intends domestic refineries to meet at least 70% of total national demand.19

Footnotes

-

Report 25/BC-CP of the Government dated 30 January 2019 on status of implementation of investment projects in the form of public-private partnership (Report 25). To our knowledge no further updated report has been prepared.

-

Reference materials in the MOIT workshop to collect opinions to complete the draft PDP8, November 2021, page 4.

-

Reference materials in the MOIT workshop to collect opinions to complete the draft PDP8, November 2021, page 5.

-

Report 32/BC-BCT, page 9

-

Reference materials in the MOIT workshop to collect opinions to complete the draft PDP8, November 2021, pages 22 and 24.

-

Reference materials in the MOIT workshop to collect opinions to complete the draft PDP8, November 2021, pages 18 and 20

-

Article 1.3(a) of the revised PDP7.

-

Reference materials in the MOIT workshop to collect opinions to complete the draft PDP8, November 2021, page 22.

-

Reference materials in the MOIT workshop to collect opinions to complete the draft PDP8, November 2021, page 22.

-

Report 25.

-

Decision 1454/QD-TTg of the PM dated 1 September 2021 on approval of the master plan for the road network for the period up of 2021 to 2030 with a vision to 2050.

-

Decision 1579/QD-TTg of the Prime Minister dated 22 December 2021 approving the master plan for development of Vietnam's seaport system for the period of 2021 to 2030 with a vision to 2050.

-

Transport Ministry proposes allowing private firms to invest in airport projects (vietnamnet.vn)

-

Resolution 556/NDQ-UBTVQH14 dated 31 July 2018 of the Standing Committee of the National Assembly, available here.

-

http://baochinhphu.vn/Kinh-te/Ha-tang-duong-sat-gia-nua-Giai-phap-nao-de-thu-hut-von/376009.vgp

-

Decision 1259/QD-TTg of the PM dated 26 July 2011 issuing master plan for construction of Hanoi capital up to 2030 with the view to 2050 and Decision 568/QD-TTg of the PM dated 8 April 2013 on approval of adjustments to the master plan for transportation development of HCMC up to 2020 with the view to after 2020.

-

Section II.2(b) of Resolution 55- NQ/TW of the Politburo of Vietnam dated 11 February 2020 on the orientation of the National Energy Development Strategy of Vietnam to 2030, with a vision to 2045 (Resolution 55).