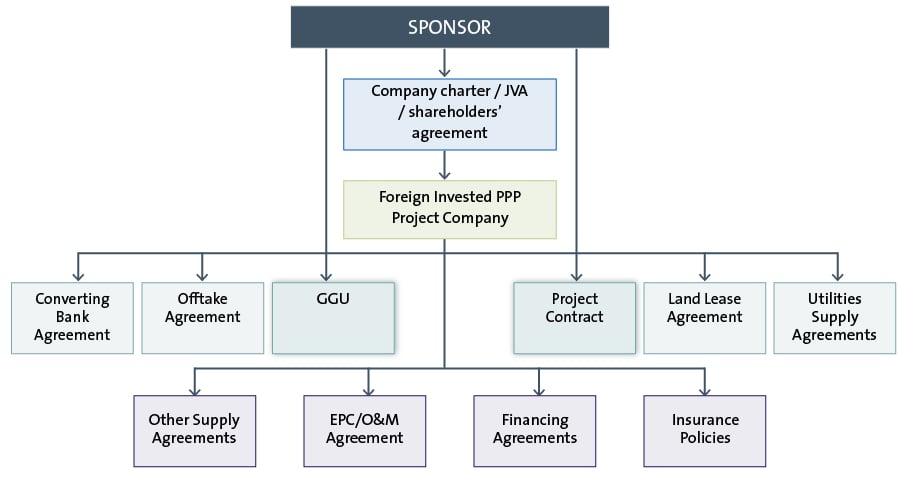

Project structure

While no two projects are the same, and each requires careful consideration in terms of structuring, the below diagram illustrates a typical contractual structure for a PPP project implemented using project finance. In Vietnam, a number of BOT/PPP power projects have been successfully financed by international lenders using this structure, though not under the current PPP Law.

In a non-PPP project, to obtain international financing a similar contractual structure is expected, except that there may be no project contract1 and GGU.

Financing structures

Project finance

Project financing is the provision of funding for a discrete single-purpose investment on a non or limited-recourse basis, with repayments principally being made from the income streams generated by such investment. So far, large-scale infrastructure projects in Vietnam have typically been financed on a non or limited-recourse project finance basis.

Typical sources of funding for large infrastructure projects have come from commercial banks (including international and local banks), development finance institutions, export credit agencies, bonds, equity, packaged up with additional credit support such as completion guarantees, performance bonds, deferred payments, and insurance.

Bankability issues

Key bankability issues

Infrastructure projects commonly face issues and risks that can't be effectively mitigated or addressed without involvement from third parties – notably, the state. While many investors have sought GGUs to backstop certain risks (eg state-owned entity obligations, currency availability and convertibility), the Government has only agreed to them in a limited number of cases for projects considered to be nationally significant (around 10 so far). In recent years, the scope of GGUs has become more limited as the Government seeks to reduce its exposure to privately-funded projects, claiming that improvements in the country's legal system and general market conditions don't justify the previous levels of support.

Below, we identify the top 10 issues we see affecting the bankability of infrastructure projects in Vietnam, and comment on how they might be addressed in a GGU – via PPP project contracts or otherwise.

Nationalisation and compensation

Though rare, nationalisation is a major government risk for foreign investors. While protection against nationalisation is provided in domestic law and international investment treaties, this protection is often not adequate for specific projects, and needs to be further addressed in project agreements.

Notably, in recent draft GGUs, a guarantee against nationalisation has been absent. In PPP project contracts, nationalisation would usually be treated as a Government event for which full compensation is payable.

Political risk insurance, from private and/or multi-lateral sources such as MIGA, might also be a tool to manage nationalisation risk.

Legality of project documents

The risk of project contracts not being valid or permits being challenged is best mitigated by a specific Government commitment that the documents, as well as rights and assets created under them, are valid and lawful under Vietnamese law. This might take the form of a legal opinion provided by the Ministry of Justice, relied on by investors and lenders. If a key document is found to be invalid, unenforceable or terminated, it would then become a Government event for which compensation is payable.

Changes in law or policy

In recent years, protection against changes in law for BOT power projects has been included in BOT contracts. This regime provides contractual protection to investors from unfavourable changes in law. Investors may also be asked to share with the state the benefits that arise from a favourable change in law.

The guidance for formulating model contracts in Decree 35 states that the model contract will provide for contract amendments in the case of change in law or policies. It also states that the model contract will regulate, amongst other matters, changes in law or policies that affect the implementation of the project contract and the revenue loss sharing.

Protection of this nature for non-PPP projects is limited to the protections set out in the Law on Investment. There is no clear precedent to date as to how willing the authorities will be in negotiating a change in law clause in a project contract (if any) if a project is implemented on a non-PPP basis.

Approvals and permits

There is currently no protection available under domestic law or investment treaties for difficulties or delays obtaining relevant approvals and permits for a project. PPP project contracts and/or the GGU may provide Government commitments to assist investors with procedures. Again, this support is limited in practice and is unlikely to be expressly forthcoming for non-PPP projects.

Foreign currency conversion

At the start of Vietnam's PPP regime, the Government was expected to provide foreign currency availability and conversion guarantees for 100% of the project's foreign currency needs. More recently, such guarantees have been limited to 30% of Vietnamese Dong revenue after deducting local expenses. This 30% limit has now been enshrined in the new PPP Law.

Foreign currency guarantees can also be given under the general investment law regime if there is appetite from the Government to give support. It is expected that the 30% threshold will still apply in such cases, although the law does not limit it expressly.

Private currency hedge products may be available to mitigate this risk, but obviously come at a cost that can adversely affect project economics.

Guarantee of performance by state entities

Many projects rely partially or wholly on revenue streams from state-owned offtakers. If they default on their obligations, payment or otherwise, projects can quickly grind to a halt. Previously, the Government was willing to provide full guarantees of state-owned counterparty obligations to give comfort to investors and lenders. However, in keeping with contemporary policy, the Government now seeks to significantly limit the scope of such guarantees, arguing that the market should make its own risk assessment based on past performance and credit ratings of state entities such as EVN.

In practice, the Government may negotiate limited guarantees of financial obligations of key state entities for some major projects. But, again, it is difficult to see such guarantees being offered outside of the PPP regime, and even then, it would be in only highly nationally significant projects.

Governing law: Vietnamese law vs. foreign law

Foreign investors and lenders have indicated a strong preference for a well-developed foreign law, such as English or Singaporean law, to govern key project contracts, in order to provide maximum certainty. Vietnamese counterparties typically advocate strongly for Vietnamese governing law, arguing that they are more familiar with it, that the projects take place in Vietnam and that the law itself is sufficiently developed.

The practice to date has been for PPP project contracts to be governed by foreign law. However, the new PPP Law provides that Vietnamese governing law will be mandatory for the PPP project contract and any contract entered into between a Vietnam state body and investors or the project company. This means that under the PPP regime, foreign law can no longer be the governing law for the GGU and project contract.

International dispute resolution and enforcement of arbitral awards

As Vietnam is a party to the New York Convention on Recognition and Enforcement of Foreign Arbitral Awards, it has agreed to allow enforcement of arbitral awards made in, or by, an arbitral tribunal of a country that is also a party to the Convention. However, the process requires recognition and enforcement by the courts of Vietnam (which have been known to refuse awards on the grounds that the process or award fails to comply with 'fundamental principles of Vietnamese law'). Since such principles are not clearly defined, Vietnamese courts have significant discretion in practice when it comes to enforcing a foreign arbitral award.

Early termination payments

Under the PPP Law, early termination payments are allowed only in very limited circumstances – specifically, when a PPP project contract is terminated due to national interest requirements, national defence and security and protection of state secrets, or when the contract signing agency is materially in breach of the contract. However, there is no formula for calculating the termination payments in these cases, so they would need to be negotiated on a bilateral basis.

The PPP Law appears to provide for only two scenarios where termination payments can be made – for national interest, to ensure national defence and security or to protect state secrets; and in case of breach by the contract signing agency. Decree 35 seems to allow the project contract to provide for termination payments in all cases. However, Decree 35 cannot go outside the ambit of the PPP Law, so there may not be much room for investors to negotiate this issue on the basis of Decree 35's apparent broader ambit.

It is critical that project sponsors negotiate clear and detailed agreements on termination payments in project documents. Essentially, a termination following a breach by Government parties should entitle the sponsor to a payment that sufficiently covers all equity and finance costs, plus an agreed return on equity. While termination payments by the sponsor or project company are more vexed, ideally the sponsor should be seeking to cover at least its financing costs. Termination following force majeure will usually have a separate regime, depending on which party is affected by it.

Security gaps

In terms of project financing, lenders may be limited by certain restrictions on the security package they are able to take under Vietnamese law. This impacts the feasibility and/or cost of non-recourse financing. These restrictions include:

- Restriction on mortgage over land: Land users paying rent annually or entitled to a waiver of land rent (either partially or wholly), as opposed to full payment of the land rent upfront for the whole term, may not mortgage or contribute their land use rights as capital in the project company (but may mortgage or contribute assets attached to the land).

- Restriction on mortgage over land and assets attached to land with foreign lenders: Foreign lenders are not permitted to take security over land and assets attached to land in Vietnam. Only Vietnamese licensed credit institutions (which include Vietnamese branches of foreign banks) are permitted to take mortgages over land and assets attached to land in Vietnam (in respect of their own loans and not on behalf of a foreign lender or in respect of a foreign loan). While various creative structures are often considered to navigate this restriction in practice, none have been properly tested in practice.

Other key Vietnamese law issues related to financing

| Borrowing limits – Under Vietnamese law, a borrower issued with an 'investment policy approval' and/or an 'investment registration certificate' approving its investment project may only borrow long-term funds (ie borrowing with repayment terms of a year or more) to implement that project – up to the limit of the difference between the borrower's equity and the total amount of registered investment capital specified in its investment registration certificate. | |

| Overall national borrowing limit – There is an overall limit on the total amount of foreign loans for the whole country approved by the PM for each year. Technically, if the national loan limit for the year (which we understand is around USD5.5 billion/year) is exceeded, registration of the loan, a prerequisite to disbursement of long-term loans, may be refused by the State Bank of Vietnam. | |

| Thin capitalisation – In line with the PPP Law, an investor's equity ratio must be no less than 15% of the total investment capital of the project. There is also a thin capitalisation requirement for non-PPP project companies using land leased from the state, being 20% for projects using a land area of less than 20 hectares and 15% for projects using 20 hectares or more. There may also be further thin capitalisation requirements in line with regulations governing specific sectors. Project lenders will also impose their own equity controls as a condition of finance. |