Problems still at play

Homebuilding levels aren't matching huge population growth

Despite the substantial increase in Australia's population in recent years, home construction has not kept pace. With the country's current population currently at 26 million—a growth of over 30% in the last two decades—there has been a surge in the demand for new homes. However, national construction activity has remained largely constant, raising substantial implications for growth and housing availability. We need to expand development to match population growth.

Major supply problems need major consideration

The current supply of housing in Australia is diminishing. This reduction is being met with major economic challenges in the field of development, precisely as demand is soaring. Without thoughtful intervention, there are potential risks that span the entire housing spectrum, stemming from insufficient supply at all levels.

National housing shortfall

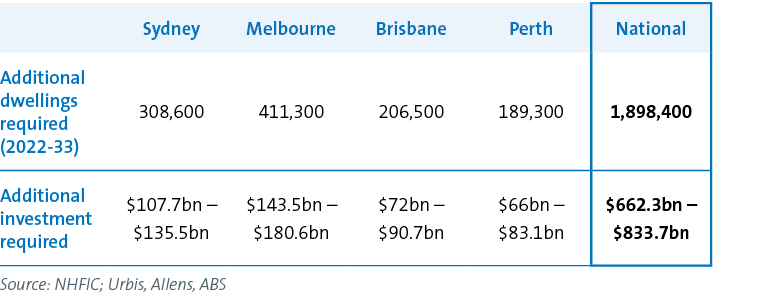

The National Housing Finance and Investment Corporation (NHFIC) estimates that 1.9 million additional dwellings are required over the next decade. This would require investment somewhere in the order of $660-830bn. Beyond this investment requirement, the NHFIC identifies a need to unlock a further 68,000 additional dwellings in the planning system to meet excess demand compared to new dwelling approvals.

Housing investment requirement 2022-33 by major city

Decreased activity and surging demand driving up rents

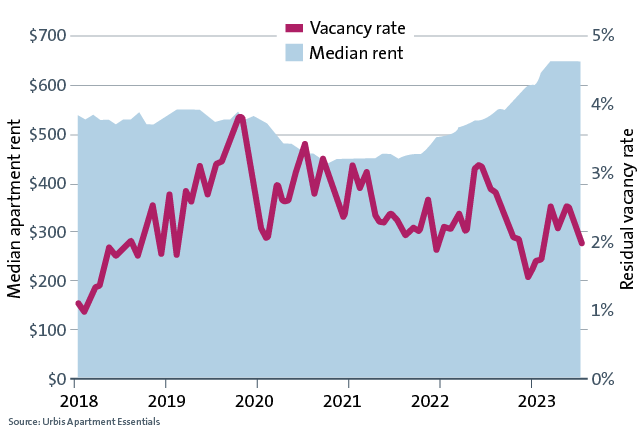

This shortfall is already having profound impacts and is being felt most acutely in the eastern seaboard’s inner-city rental markets, where an ongoing lack of supply and surging demand are driving up rents. Nationally, new dwelling completions have decreased by 19% since December 2017. With demand remaining strong, this has resulted in a 24% increase in the median apartment rent.

Median apartment rent & vacancy – Melbourne, Sydney, Brisbane, Perth, ACT (GCCSA)

Proposed policies could stall much-needed supply

We must avoid short-sighted policies that may be politically popular but damaging for long-term supply. If, as the Victorian Government worryingly proposed, rent caps were to be put in place, a significant number of developers and investors would pull out of the BTR market. It would also stall major projects while there was uncertainty as to whether or not rent caps would be implemented. Their exit would cause major disruptions to the supply of dwellings right when an increase in dwelling numbers is the key to tackling the housing crisis. While the door has been closed on rent caps for now, it hasn't been slammed shut and questions will continue to be asked on whether such policies should be introduced.

If we look both nationally and globally to places where they have enforced rent caps, we see that outcomes don't improve—they deteriorate. Research by the National Bureau of Economic Research (NBER) in San Francisco found that landlords affected by rent control reduced rental housing supply by 15%, causing a 5.1% city-wide rent increase.1 Rent caps often result in a tighter market and increased rental prices.

We caution strongly against this proposal as it will impact housing supply, deter investment and ultimately put upward pressure on rents.

Overcoming problems and driving solutions

BTR could supply a large volume of stock

The BTR sector continues to emerge as an important contributor to rental markets. To date, the sector has delivered 7,135+ apartments over the past five years, with a further 38,300 apartments in the pipeline. While BTR is still in its infancy in Australia, as it evolves there will be potential to add a substantial volume of stock to the market.

This will be vital to providing homes to a whole variety of households, while also reducing the push-down effect that is crowding more people out of the private rental market into other forms of affordable or social housing. Ultimately, it aims to address the issue of housing scarcity.

Fund-through arrangements will continue to dominate

As we predicted in our 2019 BTR paper [PDF], fund-through arrangements have become a dominant trend in the BTR sector. We expect this to continue in 2023 as private developers with quality sites develop projects on a fund-through basis for long-term BTR investors. The model:

- allows developers to develop and sell stock in the current market that they otherwise couldn't

- allows investors to acquire new assets with minimal development risk

- is stamp duty efficient.

BTR towers to form part of mixed-use precincts

We expect an increasing number of BTR projects will form part of mixed-use precincts. Not only is this due to a lack of available land, but it also provides a community atmosphere and an important level of amenity for tenants. However, in our experience, complex issues regarding strata titling, shared services and the use of common spaces will need to be carefully negotiated.

It is worth noting the role BTR will have in unlocking more than just housing investment. It will be a catalyst for other forms of productive renewal in our cities.

MIT changes to unleash a new wave of capital

Over the past 18 months, we have seen a strong flow of capital into the sector in Australia, with a large number of new funds being established. With the concessional withholding tax rate of 15% now applying to eligible BTR assets, and with economic fundamentals in Australia perfectly positioned for the residential rental market, we expect this flow of capital to pick up pace, with offshore investors that may have been initially reluctant now having the confidence to jump into the Australian BTR market. However, proposals such as rent caps could erode all the good work achieved by these policies.

Footnotes

-

See: The effects of rent control expansion on tenants, landlords and inequality evidence from San Francisco | National Bureau of Economic Research