How boards should respond

The need for robust executive remuneration frameworks is becoming increasingly important as companies tackle the challenges arising out of the COVID-19 pandemic, a heightened regulatory environment and the need to strike the right balance with executives to drive and reward conduct and performance that aligns with the company's long-terms interests.

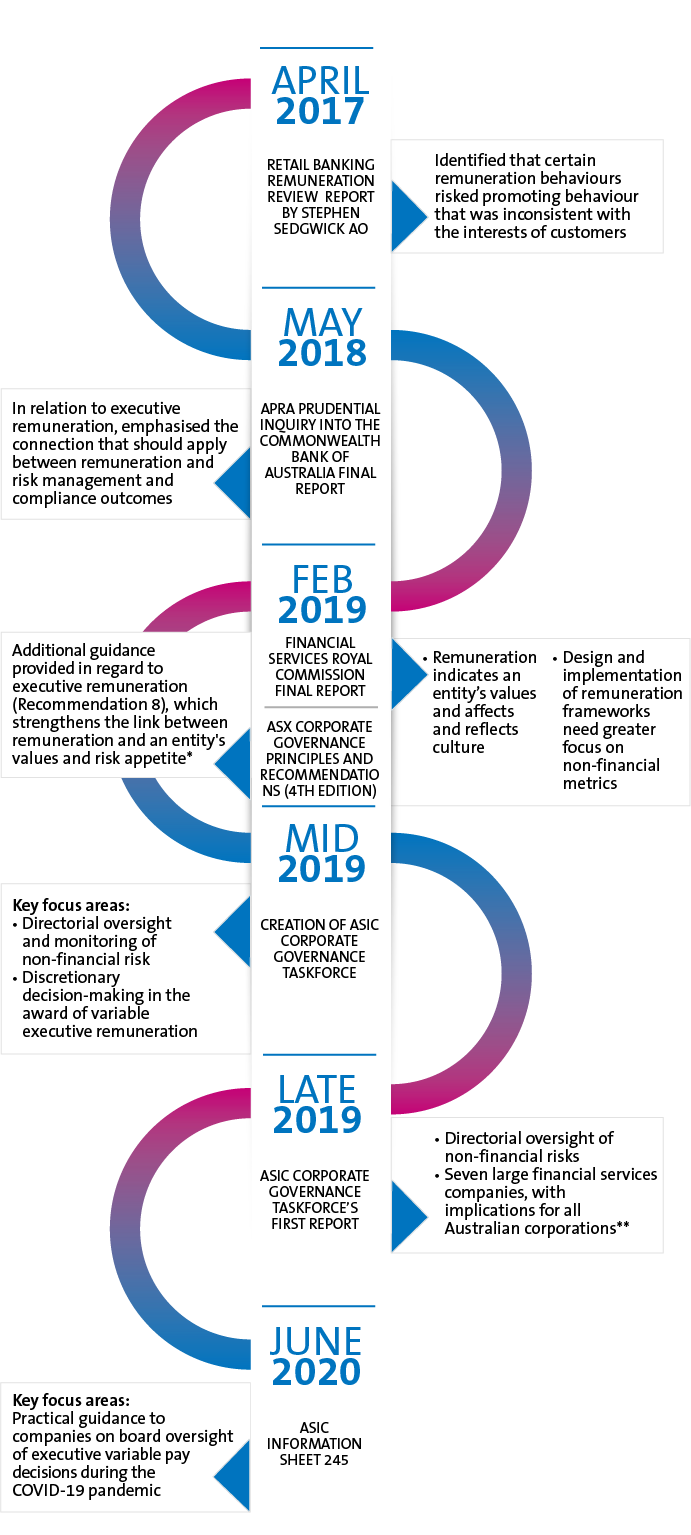

As we progress through AGM and reporting season, boards should be aware of the ongoing shifts in remuneration practices, which have been accelerated by the recommendations of the Financial Services Royal Commission (Royal Commission) and the work of ASIC's Corporate Governance Taskforce.

ASIC has released Information Sheet 245, which gives practical guidance to boards on oversight and discretion in the context of variable executive remuneration practices. Recently, we have seen a number of ASX listed entities announce reductions in board remuneration and decreases in (or an entire suspension of) short term incentives for FY20 as a result of the COVID-19 pandemic.

In this article, we share our insights on the recent developments, consider how remuneration practices are changing and examine the implications for your business.

What boards need to focus on:

Active, timely and consistent exercise of discretions

Structured and contextual information from independent sources

Arrangements to manage conflicts

Transparent recording and communication of decisions

Recent ASIC guidance

To ensure effective and informed decision making on executive remuneration, ASIC's latest guidance suggests boards should focus on: active, timely and consistent exercise of discretions, structured and contextual information from independent sources, arrangements to manage conflicts, and transparent recording and communication of decisions.

With that in mind, our key recommendations for boards are as follows:

1. Exercise of discretions

Ensure your frameworks provide you with flexibility when awarding variable executive remuneration, especially in light of the current business environment. The exercise of discretions should be active, timely and consistent, with the objective of ensuring that variable pay outcomes are appropriate in light of potential shifts in company priorities and/or operating and financial conditions.

Practical ways you can do this

- consider executive remuneration throughout the year, including the appropriateness of your company's policies and changing market conditions;

- ensure the incentive plan rules and relevant employment contracts are clear and consistent and specify that all payments are subject to the plan rules, which do not form part of the employment contracts;

- include behavioural gateways for the award of incentive pay;

- adopt scenario planning in advance of pay determinations, in order to take a consistent approach over time; and

- have a 'look back' before the vesting of deferred pay granted during this period.

2. In making decisions on executive remuneration, you should use a range of independently sourced information wherever possible

For example, from control functions within your company (finance, risk, internal audit) and independent third party advisors. Engaging external consultants in this manner is already relatively standard practice for many listed companies, and we expect this focus to continue. Boards should also actively manage conflicts of interest and make sure there is an appropriate flow of information between the Board and relevant committees for the purposes of variable executive pay decision-making (eg, via joint committee meetings and/or dedicated time for cross-committee members to make contributions).

Practical ways you can do this

- require executives who are the subject of variable pay decisions to recuse themselves during relevant meetings;

- use information provided independently of the relevant executives; and

- ensure remuneration committees have enough time to scrutinise and debate outcomes and apply independent judgment.

3. Consider the level of detail to include in remuneration reports regarding variable executive pay decision making

ASIC suggests:

- including the rationale for the exercise (or not) of discretion, the governance processes adopted and an explanation of how the company's circumstances and issues were taken into account; and

- board and remuneration committee minutes should record the key points of discussion on how and why executive variable pay outcomes were determined.

While detailed information in the remuneration report about the rationale of the exercise (or not) of discretion may be impractical at times, proper documentation and minuting will give you greater protection if your decisions are subsequently called into question. This is already a focus for companies, with remuneration reports often strongly emphasising how variable remuneration is 'at risk' and subject to discretion.

4. Get the right balance between procedural aspects of remuneration decision-making and the substance of your company's remuneration policies

In recent times, consistent with the findings of the Royal Commission, many companies have started to adjust the mix between fixed and variable pay, and to change how variable pay is calculated, with a growing emphasis on non-financial performance.

5. Consider the organisational impact of your entire remuneration structure

While focus is usually on senior executive remuneration (which is important), you should also consider how your company remunerates lower and middle-level employees and the suitability of any employee incentive schemes.

Why is this important

While ASIC Information Sheet 245 focuses on the variable pay decisions of 'large listed companies' in relation to their 'most senior executives', its recommendations are generally relevant to any company, regardless of size and scale. In time, we expect ASIC's attention will broaden beyond large listed companies, to all listed companies.

Why is it important to get this right?

It affects your corporate culture. As highlighted by the Royal Commission, appropriate remuneration frameworks help to motivate employees and drive desired behaviours and culture in organisations. See our earlier insight regarding the importance of corporate culture.

It affects your corporate culture. As highlighted by the Royal Commission, appropriate remuneration frameworks help to motivate employees and drive desired behaviours and culture in organisations. See our earlier insight regarding the importance of corporate culture.

You should be prepared for the increase in regulatory focus. In designing and implementing remuneration frameworks, adherence to ASIC's guidance is another pillar of defence that can help protect you and your company from adverse regulatory attention. As noted by Commissioner Hayne during the Royal Commission, 'poorly designed and implemented remuneration arrangements can increase the risk of misconduct' by companies, their officers and employees. We see ongoing regulatory focus on these issues, as evident in ASIC's establishment of the Corporate Governance Taskforce. When combined with its shift to a 'why not litigate' enforcement mindset, it is prudent for board's to take heed of ASIC's expectations.

You should be prepared for the increase in regulatory focus. In designing and implementing remuneration frameworks, adherence to ASIC's guidance is another pillar of defence that can help protect you and your company from adverse regulatory attention. As noted by Commissioner Hayne during the Royal Commission, 'poorly designed and implemented remuneration arrangements can increase the risk of misconduct' by companies, their officers and employees. We see ongoing regulatory focus on these issues, as evident in ASIC's establishment of the Corporate Governance Taskforce. When combined with its shift to a 'why not litigate' enforcement mindset, it is prudent for board's to take heed of ASIC's expectations.

You have a duty of care: As a director, you owe a duty of care to take reasonable steps to guide and monitor the management of your company, including through appropriate information reporting systems to keep you apprised of material developments. This duty applies as much to decisions on executive remuneration as it does to any other critical aspects of your business.

You have a duty of care: As a director, you owe a duty of care to take reasonable steps to guide and monitor the management of your company, including through appropriate information reporting systems to keep you apprised of material developments. This duty applies as much to decisions on executive remuneration as it does to any other critical aspects of your business.

It helps to evidence your sound 'business judgement': In making decisions about how you structure your company's remuneration policies and award pay to senior executives, and seeking to have protections available under the 'business judgement' rule relating to the duty of care and diligence, it will be necessary for you to show that: (i) you made the judgment in good faith; (ii) you did not have a material personal interest; (iii) you informed yourself about the subject matter of the judgment; and (iv) you rationally believed the judgment was in the best interests of the company. The existence of a robust decision-making process that is free from conflicts of interest, and the adequate documentation of these decisions, will assist you in satisfying these elements, if it ever proves necessary.

It helps to evidence your sound 'business judgement': In making decisions about how you structure your company's remuneration policies and award pay to senior executives, and seeking to have protections available under the 'business judgement' rule relating to the duty of care and diligence, it will be necessary for you to show that: (i) you made the judgment in good faith; (ii) you did not have a material personal interest; (iii) you informed yourself about the subject matter of the judgment; and (iv) you rationally believed the judgment was in the best interests of the company. The existence of a robust decision-making process that is free from conflicts of interest, and the adequate documentation of these decisions, will assist you in satisfying these elements, if it ever proves necessary.

What we know about executive remuneration

To explore how market practices are evolving, we examined the FY18 and FY19 remuneration reports of the top 20 ASX listed entities and identified the following key trends.

![]()

In many cases, a greater proportion of overall executive pay was based on variable rather than fixed.

![]()

Board discretion was often used to vary the level of variable remuneration based on business performance and industry and shareholder concerns. For some executives, short-term variable pay was reduced to zero in FY19.

![]()

While financial considerations were generally still the favoured metric for short-term variable remuneration, increasing weight was placed on non-financial considerations, such as customer satisfaction, people and culture, safety and risk and reputation.

![]()

An increased focus on non-financial risks was especially the case in the financial services industry, in the wake of the Royal Commission, where the average weighting given to financial considerations for short-term variable remuneration was reduced across the major banks from approximately 50% in FY18 to around 30% in FY19. We expect further developments in the financial services space, with APRA considering the creation of a new cross-industry prudential standard aimed at clarifying and strengthening remuneration requirements for all APRA-regulated entities, to address recommendations of the Royal Commission.

We are also seeing some companies reduce board remuneration and reduce or cancel short term incentives for FY20 in light of the COVID-19 pandemic.

Don't forget about lower-level employee remuneration

While corporate culture is set by the tone from the top — and accordingly the remuneration and conduct of senior executives is crucially important — so too is the incentivisation of lower-level employees, who necessarily make up the majority of the staff in any organisation.

In a number of recent decisions, Australian courts have identified commission-based sales structures and incentive schemes as a key contributor to corporate misconduct. In considering the appropriate design of employee remuneration structures, it is helpful to consider some of the recommendations made by Stephen Sedgwick AO in his review of retail banking, which included:

- the removal of variable reward payments that are directly linked to sales or the achievement of sales targets;

- that any variable reward should be based on an overall assessment of employees' performance against a range of factors that reflect the breadth of their responsibilities;

- that incentives should be awarded using a scorecard-based approach, with a maximum weighting for financial measures of no more than 33%; and

- that variable reward payments should amount to a relatively small proportion of fixed pay.

While no 'one size fits all' approach can be taken to employee remuneration, these recommendations are worth considering, regardless of your company's size or sector. Boards and senior managers have a responsibility to monitor their company’s affairs and policies and ensure they are fit for purpose. Examining the adequacy of your company's remuneration policies, including for lower level employees, is a key aspect of this.

What's next

ASIC Information Sheet 245 is the latest instalment in the work of ASIC's Corporate Governance Taskforce. Prior to this, in 2019, the Taskforce examined directorial oversight of non-financial risk and how Boards approach the award of variable executive pay. See our earlier insight for our key takeaways regarding the Taskforce's report on that topic.

The Taskforce is intending to release a detailed report on its findings in relation to board oversight of variable remuneration structures later in 2020. ASIC has also indicated that the work of the Taskforce will continue to be part of its strategic priorities over the next few years, particularly in relation to executive pay decisions and in response to the COVID-19 pandemic and beyond. We will keep you updated on any developments.

* Read more: What this means for remuneration

** Read more: ASIC Corporate Governance Taskforce Report