Here's what you need to know 12 min read

Australia is transitioning to a new mandatory and suspensory merger regime. Acquisitions that come into effect on or after 1 January 2026 and that satisfy the relevant criteria must first be notified to, and cleared by, the Australian Competition and Consumer Commission (ACCC).

1 July 2025 marked the official commencement of the transition period. Businesses can now choose to voluntarily notify the ACCC of transactions under the new merger regime.

In this Insight, we outline the details of the new regime as of 1 July 2025. You can also download our quick guide here.

Key takeaways

- Australia is transitioning to a new merger control regime. Acquisitions that: (i) come into effect on or after 1 January 2026; (ii) are 'connected with Australia'; (iii) satisfy certain monetary and control thresholds; and (iv) do not benefit from an exemption, must first be notified to, and cleared by, the ACCC. Significant filing fees are payable. Non-compliance can result in significant penalties and the transaction being void.

- Parties can now notify the ACCC of a transaction under the new regime. Parties whose transactions are at risk of being captured by the new regime should consider voluntarily notifying the ACCC now to avoid delays in 2026.

- The ability to seek informal clearance from the ACCC remains until 31 December 2025 (though parties are encouraged to submit their applications by 30 September to be considered in time). Acquisitions that are informally cleared between 1 July and 31 December 2025 will be exempt from notifying under the new regime so long as the transaction completes within 12 months of clearance.

How will the notification thresholds work?

An acquisition will require notification (unless exempted) where:

- it meets the monetary thresholds;

- it involves an acquisition of control; and

- the target is 'connected with Australia'.

An acquisition will be notifiable only if it meets either of the following monetary notification thresholds:

- 'acquisitions resulting in large or larger corporate groups'; or

- 'acquisitions by very large corporate groups'.

|

Acquisitions 'resulting' in large or larger corporate groups |

Acquisitions 'by' very large corporate groups |

|---|---|

|

|

Australian revenue is gross revenue for the most recent 12-month financial reporting period, from transactions/assets within or into Australia.

Revenue of the acquirer

When calculating the Australian revenue attributable to the acquirer, the revenue of the acquirer's 'connected entities' must be included.

Two entities are connected if:

- they are 'related bodies corporate' under s4A of the Competition and Consumer Act 2010 (Cth) (CCA);

- one controls the other (including joint control with an associate). 'Control', as defined in s50AA of the Corporations Act 2001 (Cth), refers to the capacity to determine the outcome of decisions regarding an entity's financial and operating policies; or

- they are both controlled by a common entity.

Revenue of the target

When calculating the Australian revenue attributable to the target group, the approach will depend on whether the acquisition is of shares or assets.

Where the acquisition is of shares in a body corporate, revenue includes the Australian revenue of any of the target's 'connected entities' that are being directly or indirectly acquired. See 'revenue of the acquirer' above for the meaning of 'connected entities'.

Where the acquisition is of assets, revenue includes:

- the Australian revenue of the asset's owner that is attributable to the asset; or

- where such an attribution is not reasonably practicable, 20% of the market value of the asset.

Creeping or serial acquisitions thresholds

In order to address creeping or serial acquisitions, the thresholds have a 'cumulative Australian revenue' limb that can be satisfied by aggregating:

- the Australian revenue of the proposed target; and

- the Australian revenue of any previous similar targets acquired over the last three years by the acquirer or their connected entities. A previous target will be similar if both the previous and proposed target relate to the carrying on of a business that predominantly involves the supply or acquisition of the same goods or services, or goods and services that are substitutable for, or otherwise competitive with, each other (disregarding any geographic factors or limitations). The Australian revenue of previous acquisitions is to be measured at the time (or 'contract date') of the previous acquisition.

The following previous acquisitions can be excluded from the aggregation:

- previous acquisitions which have been notified (unless notified under the serial acquisitions limb);

- previous acquisitions where target turnover was less than $2 million; and

- previous acquisitions where the target was not connected with Australia.

There is also an exemption to the serial or creeping acquisition threshold where the proposed target has Australian revenue of less than $2 million.

While the notification threshold takes into account only past acquisitions of the acquirer, the ACCC will consider previous acquisitions by both the acquirer and target as part of its substantive assessment. Both the short- and long-form notification forms request details about the merger parties' relevant past acquisitions.

An acquisition will be notifiable only if it results in the acquirer obtaining control over the target. 'Control' is the capacity to determine the outcome of decisions regarding the target's financial and operating policies (ie control under s50AA of the Corporations Act), but also includes (i) joint control with an 'associate', and (ii) control by a special purpose vehicle.

As defined in s51ABJ of the CCA, an acquisition of shares in 'Chapter 6' entities, including listed companies, unlisted companies of more than 50 members, or a listed registered scheme, does not require notification if, following the transaction, the acquirer's voting power remains 20% or less.

A share or asset is connected with Australia if the share is in a body corporate that carries on business in Australia, or the asset is used in, or forms part of, a business carried on in Australia.

This means that transactions will only be captured where there is an existing nexus to Australia (ie the target has a current market presence in Australia).

There are several exemptions to the notification thresholds, namely:

- acquisitions in insolvency processes by administrators, receivers, managers or liquidators. However, any acquisitions from administrators, receivers, managers or liquidators are still subject to notification requirements.

- internal restructures and reorganisations of entities that are 'related bodies corporate' under s4A of the CCA or are related by means of a trust or partnership.

- acquisitions that occur by automatic operation of federal, state or territory laws.

- certain routine acquisitions in clearing and settlement activities.

- certain routine trading and fund or capital raising activities.

- acquisitions of certain financial instruments (ie derivatives, debt instruments, debt interests, asset securitisation arrangements, securities financing transactions, security interests etc).

- certain classes of land acquisitions, namely:

- acquisitions made for the purpose of developing residential premises.

- certain commercial property acquisitions by businesses primarily engaged in buying, selling, leasing or developing land, where the acquisition is for a purpose other than operating a commercial business on the land.

- extensions or renewals of a lease for land.

- acquisitions of a legal interest in land, or acquisitions of a subsequent equitable interest where the acquisition of the initial equitable interest in that land was notified.

The merger legislation also empowers the Minister to determine classes of acquisitions that are required to be notified regardless of whether they meet the monetary thresholds, result in control or satisfy any of the exemptions.

The current prohibition on acquisitions that 'substantially lessen competition' (under s50 of the CCA) will continue to apply to all acquisitions that are not notified under the new regime. The ACCC encourages parties to notify acquisitions that are at risk of contravening this prohibition even if they do not otherwise require notification. Notified acquisitions are exempt from the operation of s50 but will need to be cleared by the ACCC before being put into effect.

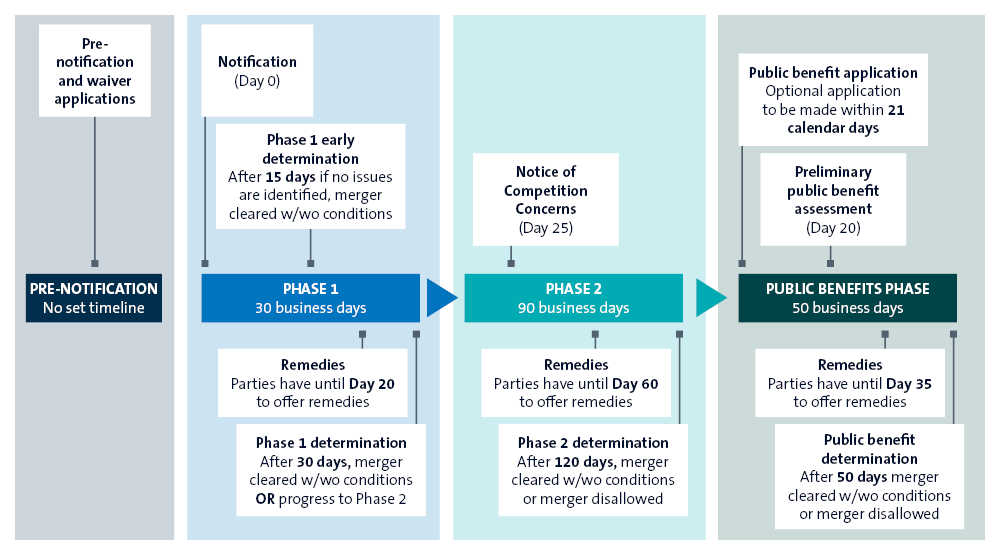

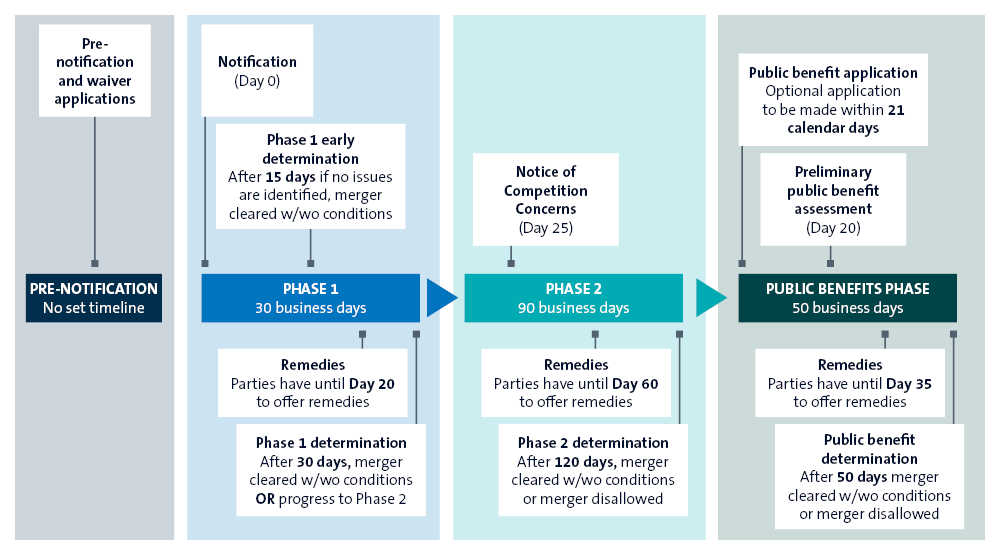

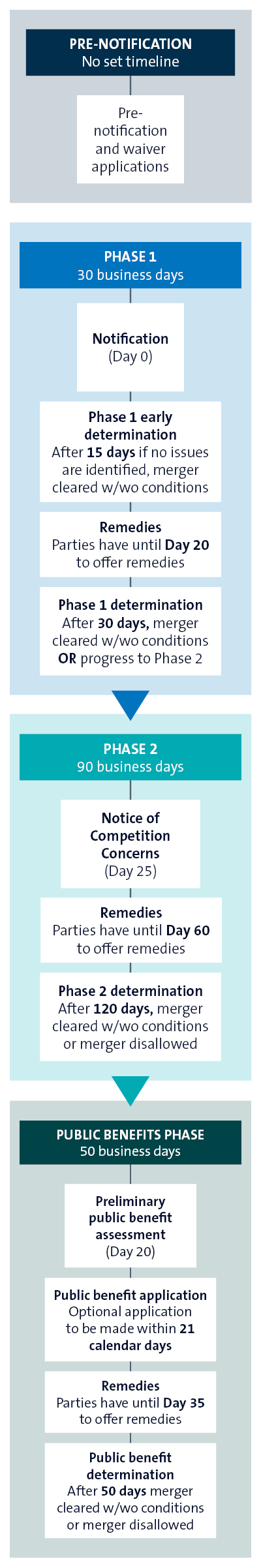

What are the key aspects of the ACCC's process?

NB: All timeframes are in business days unless otherwise stated.

Appeals: Parties (including third parties with sufficient standing) may apply for limited merits review, within 14 calendar days of the ACCC's assessment, before the Australian Competition Tribunal. Merits review can take 45-90 calendar days (extendable by up to 150 calendar days).

Standstill for appeals: Where the ACCC clears the transaction, parties must still wait 14 calendar days after the ACCC's determination to allow for the Tribunal appeal period to elapse before proceeding with the transaction.

The ACCC envisions that the pre-notification process can be used to raise any issues and discuss possible areas of focus to reduce the likelihood of extensive information requests and delay of the determination period. Parties involved in concentrated markets, global transactions or which may be required to provide a remedy are encouraged to engage in early pre-notification. As in overseas administrative regimes, we anticipate the ACCC will use this period to identify any possible areas of focus or concern and identify additional information that should be covered by the notification before it is formally filed.

Requests for pre-notification engagement will be made via the ACCC's online merger portal (once live, and by email until then). Once submitted, the ACCC will endeavour to contact parties within five business days.

From 1 January 2026, parties to an acquisition can seek a waiver from notification. If granted, notification will not be required.

In assessing waiver applications, the ACCC will consider the object of the CCA (that is, to enhance the welfare of Australians through the promotion of competition and fair trading and provision for consumer protection), the interests of consumers, the likelihood that the acquisition would meet the notification thresholds, and the likelihood that the acquisition would, or would be likely to, substantially lessen competition.

Waiver applications will not be kept confidential and will be available on the ACCC's Acquisitions Register to allow interested third parties to make submissions. A summary of any ACCC decision in relation to the waiver application will also be made available on the Acquisitions Register. The ACCC expects to make most waiver determinations within 20 business days of receiving a waiver application.

As at 1 July 2025, the legislative instrument relating to the waiver process has not been finalised and further guidance from Treasury is expected in the coming months.

Acquisitions that 'are notified' (including voluntarily) or are 'required to be notified' will be 'stayed'. This means parties will contravene the CCA if the acquisition is put 'into effect' prior to the ACCC's merger determination.

The ACCC's Interim Process Guidelines indicate that putting an acquisition 'into effect' does not necessarily require the full transfer of legal ownership. For instance, putting the acquisition 'into effect' may include pre-completion activities such as terminating employment of key employees, closing key facilities or integrating IT systems.

A party will not put the acquisition 'into effect' by merely entering into conditional acquisition agreements, such as those with condition precedents including obtaining regulatory approval, until they become binding.

FIRB will continue to notify the ACCC of any foreign transactions that my raise competition concerns, as under the current regime.

A fee will be payable at each stage of the ACCC's review as follows:

| Stage | Fee |

|---|---|

| Notification waiver application | $8300 |

| Phase 1 assessment | $56,800 |

|

Phase 2 assessment:

‘Global transaction value’ is the higher of the market value of the acquired shares / assets or consideration receivable from the acquisition. |

$475,000 $855,000 $1,595,000 |

| Public benefits application | $401,000 |

| Tribunal review | TBC |

These fees are cumulative. For example, an acquisition that proceeds from Phase 1 to Phase 2 to a Public Benefits assessment will have to pay the prescribed fee at each stage of the assessment.

There are no additional fees for timeline extensions.

There will be short and long notification forms (with the former to be used for acquisitions unlikely to raise competition concerns). Both forms will require the provision of certain documents up front, such as transaction documents, financial reports and organisational charts.

In addition, long-form notifications will also require the disclosure of additional documents pertaining to the acquisition, which may include board documents, transaction rationale, the value of the target, competitive or market conditions and relevant product or service business plans.

The ACCC has provided guidance in relation to when parties should use the long-form notification:

- Horizontal acquisitions: where parties supply or potentially supply products or services in the same market, and the combined market share post-acquisition is:

- equal to or greater than 40% and the increment resulting from the acquisition is equal to or greater than 2%; or

- equal to or greater than 20% but less than 40% and the increment resulting from the acquisition is equal to or greater than 5%.

- Vertical acquisitions: where a party supplies products or services in a market that is upstream or downstream from a market in which another party to the acquisition supplies products or services and both parties have a market share of at least 30% in their respective upstream and downstream market.

- Conglomerate acquisitions: where the parties supply 'adjacent' products or services and one of the parties to the acquisition has an estimated market share equal to or greater than 30%.

- Other circumstances: the ACCC has suggested that use of the long form may be appropriate even where the above criteria are not met, particularly where the merger involves:

- a 'vigorous and effective competitor'; or

- the acquisition of a firm developing a significant product in a market where the parties potentially overlap.

The short-form notification can also be used for acquisitions involving only an interest in land.

There will also be separate forms for:

- Public benefits assessments: this form includes, for example, identification and evidence in support of public benefits, as well as identification of any known or reasonably ascertainable public detriments.

- Waivers: this form has not been finalised yet.

Merger parties should be aware that, following ACCC approval, a transaction must not be completed until at least 14 calendar days have passed since the approval. This is to allow any interested parties to apply to the Competition Tribunal to review the ACCC's merger determination.

Given this, the earliest parties can complete an acquisition is around five weeks after an effective notification is made (noting the ACCC cannot make a decision earlier than 15 business days). Approvals will only be valid for 12 months.

A notifying party or third party may apply to the Tribunal for a limited merits review of an ACCC merger determination. An application for review must be made within 14 calendar days after the ACCC's reasons for determination are published on the Acquisitions Register.

The Tribunal must make its determination within 90 days after the later of the last day on which an application for review could have been made, or the day the applicant gives the Tribunal further information. The Tribunal may extend this period by 60 days once, for no reason, or by another 90 days once, if it is satisfied it will need more time to review relevant materials to the matter.

If the parties want to review any interim decision of the ACCC (as distinct from any final acquisition determination), then an application will need to be made within seven days of that decision.

What are the transitional arrangements, and which regime should you use?

If your transaction is not cleared by the ACCC before 31 December 2025, the ACCC will discontinue its review and list the transaction on the public register as having ‘no decision.’ If parties do not receive ACCC informal clearance by 31 December 2025, they will need to re-notify under the new regime if the notification criteria are satisfied.

The ACCC's guidance on transitional arrangements has indicated that any informal review applications submitted on or after 1 October 2025 are unlikely to be completed before the new regime takes effect.

Even then, there may be a risk that such a review is not concluded by 31 December 2025 when the informal regime ceases to operate, and parties may have to file again under the new regime.

Acquisitions approved under the informal regime between 1 July and 31 December 2025 will be exempt from filing under the new regime, provided completion occurs within 12 months (see s189 of CCA). Otherwise, parties will need to lodge a new application under the mandatory regime if the notification criteria are satisfied. In such circumstances, the ACCC will rely upon information received under the informal regime to consider an application under the new regime more quickly.

Parties whose informal review applications were approved prior to 1 July 2025 must re-apply to the ACCC for a letter exempting the acquisition from the new regime. The request must be made between 1 July 2025 and 31 December 2025 and provide updated market shares and information. The ACCC recommends that such a request be made before 1 October 2025.

Due to the uncertainty that surrounds the volume of applications the ACCC will receive prior to the closure of the informal merger clearance regime, the ACCC is encouraging parties to voluntarily notify under the new regime from 1 July 2025.

Depending on when parties are contemplating an ACCC filing or engaging with the ACCC, the following section may assist with decisions about which regime to use during the transitional period.

Next steps

The regime will come into full force from 1 January 2026. If your transaction is at risk of being caught by the new merger regime, please reach out. We can help you navigate the complex transitional arrangements.

We've taken a deep dive into the details of the new mandatory merger regime and transitional arrangements in our latest webinar. Follow the link below to watch now.