- Environmental, Social & Governance

- Climate Change & Sustainability

- Business & Human Rights

Getting ahead of expectations, managing risk and leveraging opportunities.

Robust management of environmental, social & governance (ESG) risks and opportunities is pivotal to commercial success, and vital in meeting the expectations of regulators, shareholders, employees and other stakeholders.

As international and domestic laws and standards continue to develop, companies need to be aware of evolving regulatory requirements and ensure compliance. It's as much about managing risk as it is about capitalising on new opportunities.

By understanding not only the current state but the future direction of the ESG landscape, organisations can also add to their social value proposition, contribute to meaningful change, participate in nascent markets and safeguard access to capital.

How we can help

Our multidisciplinary team of ESG experts assist businesses to elevate your ESG goals effectively, while balancing your other business priorities and responding to regulatory changes.

We help clients understand best practice ESG strategy, governance principles, and risk and compliance frameworks, while remaining agile in response to changes in the ESG field and stakeholders' expectations.

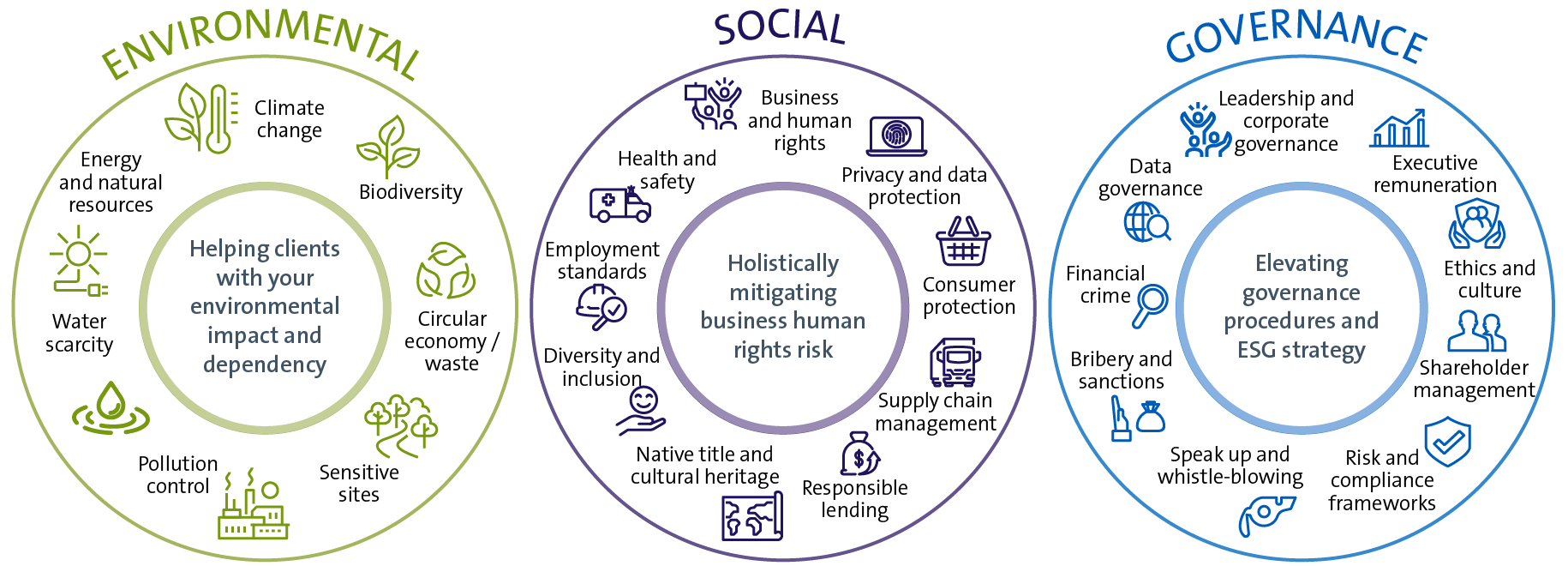

The breadth of our ESG expertise

We take a holistic approach when assessing and engaging the broad range of ESG risk and compliance – from climate change and resource efficiency, human rights and community engagement, to anti-bribery and corruption, transparency and disclosure, product governance, and risk management more generally.

A company's ESG strategy plays a critical role in setting its direction and aspirations. It serves as an invaluable guide to making sustainable and responsible decisions that contribute to long-term value creation for shareholders and positive societal outcomes. Part of that strategy should be maintaining effective ESG governance, which goes hand in hand with the discharge of directors' and officers' duties.

ESG disclosures also play a key role in managing stakeholder expectations and ensuring compliance with corporate reporting obligations. Boards need to understand their organisation's ESG-related financial risks and opportunities, and be able to justify their strategy and demonstrate reasonable grounds for material decisions in light of emerging issues and risks.

How we can help

We have advised a number of clients, across a wide range of sectors, on matters relating to ESG strategy, governance and disclosure.

This has included:

- reviewing and verifying risk and governance frameworks, including providing advice on uplifting them in preparation for anticipated changes to regulatory requirements and in light of increasing stakeholder expectations;

- conducting in-depth legal reviews of disclosures and public commitments and targets, including advising on misleading or deceptive conduct (greenwashing and bluewashing) risk, and verification of forward-looking representations;

- advising organisations on climate-related financial disclosures. This includes assisting clients with the preparation of annual and half-yearly reports (eg voluntary climate-related disclosures), as well as standalone climate and sustainability reports, having regard to statutory reporting requirements, directors' duties and ASX Corporate Governance Council Principles and Recommendations;

- assisting organisations to prepare for the commencement of mandatory climate-related financial disclosure requirements in Australia, including helping clients establish procedures to support boards to provide a directors' declaration regarding the new sustainability report and uplift of governance frameworks; and

- responses to shareholder and investor engagement on climate matters, including shareholder-led resolutions, 'Say on Climate' resolutions and AGM questions.

As businesses consider prospects for investment, acquisition or expansion, conducting ESG due diligence is vital in recognising potential risks, and facilitating sound investment and strategic choices.

We help conduct ESG due diligence on company policies, practices and statements (including during M&A transactions or when entering into arrangements with a new counterparty); and advise on the governance, monitoring and reporting processes that should be in place to demonstrate robust ESG due diligence practices to stakeholders.

How we can help

We have assisted clients with ESG due diligence matters by:

- undertaking ESG-related legal due diligence on a target business during an M&A transaction;

- conducting due diligence on the impact of the reformed Safeguard Mechanism on target companies, and negotiating detailed compliance cost allocation provisions in shareholders' agreements;

- advising on the regulatory, legal and transactional risks associated with participation in the Australian Carbon Credit Unit (ACCU) Scheme, nature repair market and related domestic and global markets, and negotiation of contractual risk allocation;

- conducting human rights due diligence on supply chains, including advising on how to manage potential and actual human rights impacts like modern slavery; and

- undertaking a full human rights risk assessment for engagement with, and impacts on, Indigenous peoples, and recommending uplifts in controls for human rights due diligence.

Businesses are consistently required to respond to new regulations and policies as they emerge. These include volatile areas of Australian law related to carbon emissions and abatement, biodiversity and nature, and business human rights.

As the legal landscape continuously evolves, we work to ensure our clients stay ahead of the game, guiding your swift responses to, and compliance with, regulatory changes.

How we can help

We have helped clients by:

- conducting internal reviews of a company's compliance with, and implementation of, its existing ESG policy, and identifying weaknesses in processes, procedures and guidelines;

- advising on the development of a program for uplift and assisting with ESG policy implementation;

- advising on reporting requirements under the National Greenhouse and Energy Reporting Scheme, the application of the reformed Safeguard Mechanism regime to clients' businesses, and options for managing Safeguard Mechanism compliance obligations (including ACCU purchase structuring and associated regulatory issues);

- reviewing, drafting and amending modern slavery statements for compliance with the Modern Slavery Act 2018 (Cth), and advising on opportunities to align with best practice; and

- assisting in providing comprehensive training for all staff in investigations, human resources, legal and compliance roles on how to conduct effective workplace and business conduct investigations on a global business scale.

Businesses are seeing an increase in ESG litigation, which can be in the form of asset-specific litigation, public law challenges, actions under financial and corporate law regulation, tort law claims and human right complaints. There is, as well, the continued rise of ESG-related shareholder activism, with campaigns taking many forms, including shareholders seeking changes to boards or opposing M&A transactions.

We are also seeing significant and continued regulatory activity and investor activism in relation to greenwashing, with a particular focus on corporates' net zero statements and targets, carbon neutral claims, fund labels, and investment exclusions and screens.

How we can help

We have assisted a range of clients on ESG litigation, shareholder activism and regulatory enforcement matters, including by:

- advising on potential exposure to climate- and nature-related litigation risk: eg in relation to matters such as greenwashing, management and disclosure, directors' duties, compliance with disclosure requirements under the Corporations Act 2001 (Cth) and other statutory duties, and climate- and nature-related project impacts;

- providing guidance on the potential implications of recent regulatory investigations and enforcement action relating to greenwashing, and climate-related proceedings brought by individual shareholders and strategic litigation groups;

- acting and advising in relation to human rights-related disputes, including litigation and complaints through non-judicial mechanisms (eg Organisation for Economic Co-operation and Development National Contact Points);

- acting in climate- and nature-related litigation, including greenwashing claims, judicial review and alleged breaches of financial regulatory laws; and

- advising on how to prepare for, and respond to, a shareholder activism campaign.